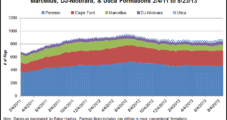

Liquids-rich and oil plays have clearly won the hearts and dollars of North American producers. The Eagle Ford and Bakken shales are stars now, but several others are poised to join or possibly eclipse them, according to a recent note by Standard & Poor’s Ratings Services (S&P).

E&P

Articles from E&P

Dallas Leaders Weighing Well Setbacks, Controversial Drilling Permits

City of Dallas officials are inching toward a conclusion to the long-running debate over how large to make the buffer zone around would-be well sites within the city. One proposal could effectively prevent drilling within the city limits, an industry advocate said.

Industry Brief

Cardinal Energy Grouphas agreed to purchase fromKansas Petroleum Resources LLCa 100% working interest in oil and natural gas leases in Kansas that cover about 17,000 acres in Pawnee and Hodgeman counties and other operational assets. The wells to be acquired are within the oil producing zones of the Mississippian Lime formation, Lansing-Kansas City limestone formation, the Cherokee Sand Basin and the Permian Chase Group formations. Financial terms of the deal were not released. The acquisition is part of Cardinal’s ongoing plan “to build a portfolio of oil and gas properties in the continental United States that are poised for further development,” the company said. The assets include 3-D seismic surveys, 19 vertical oil-producing wells and two water disposal wells that have been drilled into the Arbuckle formation, according to Cardinal CEOTimothy Crawford. Upon completion of the acquisition, Cardinal’s annual oil production is expected to increase by at least 300 b/d.

Supply Driving Down Energy Security Risk, Says U.S. Chamber

The energy security risk faced by the United States as quantified by the U.S. Chamber of Commerce fell 6.6% last year from 2011, ending a two-year run of increases, thanks mainly to oil and natural gas production from shale plays, the Chamber’s Institute for 21st Century Energy said Wednesday.

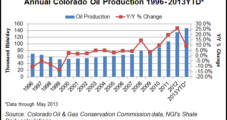

Colorado on Record Oil Output Pace

Last year’s 50-year oil production record in Colorado may be broken again this year, according to the latest production statistics from the Colorado Oil and Gas Conservation Commission (OGCC). The statistics cover January through May.

Barnett Shale’s NatGas, Oil, Condensate Production Fell in June

Production of crude oil, natural gas and condensate out of the Barnett Shale all continued to decline in June compared to both the previous month and to June 2012, according to data from the Railroad Commission of Texas (RRC).

Lawmakers Seek Fracking Exemption for Wyoming, Other Western States

The Wyoming congressional delegation Monday asked Interior Secretary Sally Jewell to exempt Wyoming and other western states currently regulating hydraulic fracturing (fracking) from the Bureau of Land Management’s (BLM) final rule on the practice, saying not to do so would delay permitting and discourage production on public land.

Meritage Midstream Grows Powder River Assets

Meritage Midstream Services II LLC has bought Thunder Creek Gas Services LLC and its more than 500 miles of gathering pipelines in Wyoming’s Powder River Basin, the company said Tuesday.

Oil/Gas Driving Colorado Economy, Researchers Find

Last year, Colorado’s oil and natural gas industry injected $29.6 billion into the state’s economy, supporting 110,000 mostly high-paying jobs, according to a study released Monday by a research unit at the Leeds Business School, University of Colorado (UC), Boulder.

Producers See Equity Heating Up, ‘Vigorous’ Enthusiasm for Permian

Exploration and production (E&P) companies remain enthusiastic about the U.S. onshore, in particular the Permian Basin, Niobrara formation, Utica Shale and the Tuscaloosa Marine Shale (TMS), based on observations at the recent EnerCom Consulting oil and natural gas conference, said two analyst teams who were there. However, Marcellus Shale pricing appears to be a “real concern for the buyside.”