U.S.-based natural gas producers are producing less while Chinese and Russian operators are producing more, according to a ranking by Societe Generale.

M&A

Articles from M&A

NGI The Weekly Gas Market Report

Kinder Mulling Deals; ‘Tremendous Opportunity’ in NatGas Growth

Midstream giant Kinder Morgan Inc. will be active in the mergers and acquisitions market in the coming months, but right now, potential sellers…

Kinder Mulling Deals; ‘Tremendous Opportunity’ in NatGas Growth

Midstream giant Kinder Morgan Inc. will be active in the mergers and acquisitions (M&A) market in the coming months, but right now, potential sellers of some attractive assets are holding on to them after being propped up by “cheap money” that has been flowing into the energy sector, CEO Rich Kinder told analysts during a conference call.

M&A Activity Sidelined as Entrenched Companies Watch Oil Price

The oil price required for natural gas and oil companies to be cash flow neutral in 2015 has dropped by more than $20.00 to $72/bbl following the industry’s aggressive cost cutting measures, according to Wood Mackenzie Ltd.

GE, Partner to Sell Four-State Gas Distribution Utility

GE Energy Financial Services and its joint venture partner Alinda Capital Partners LLC plan to sell their Colorado-based multi-state natural gas utility distribution operations, which they acquired from Kinder Morgan and others in 2007 (see Daily GPI, April 9, 2007).

New Player Pursuing Technology-Focused Buys in Oil/Gas Patch

Recently formed Kinetics Energy Services LLC has secured $100 million in startup funding and is out in the market looking for acquisition opportunities in the well completions and production enhancement sector in onshore North America.

Shell, BG Group Strike First Mega-Merger Following Oil Price Crash

Royal Dutch Shell plc has agreed to acquire UK-based BG Group plc in a deal worth about US$69.6 billion. Shell would see its proved reserves grow about 25% and would become the world’s largest producer of liquefied natural gas (LNG).

Chesapeake Utilities Completes $59.2 Million Gatherco Merger

Delaware-based Chesapeake Utilities Corp. (CUC) said it has completed its merger with Ohio’s Gatherco Inc., in a $59.2 million deal that transforms the latter into CUC’s newest wholly-owned subsidiary, Aspire Energy of Ohio LLC.

Private Equity Biting Off Big Piece of Major Mexico NatGas Pipeline

Private equity players BlackRock and First Reserve have agreed to take a 45% stake in the phase two segments of Petroleos Mexicanos (Pemex) Los Ramones Pipeline Project. The pipelines to carry U.S. gas to Mexico would be the first major midstream assets built with foreign capital since the recent reform of Mexico’s energy sector, the partners said.

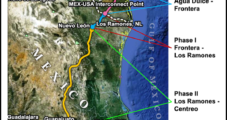

Global Upstream Oil, NatGas Investments Down 12% in 4Q2014, EIA Says

Spending on upstream investments by nearly two dozen international oil and natural gas companies in the final three months of 2014 was down $77 billion (12%) compared with the same period in 2013, according to the Energy Information Administration (EIA).