Chord Energy Corp. has agreed to acquire fellow Williston Basin producer Enerplus Corp. in a stock and cash transaction that would create a company with a combined enterprise value of about $11 billion. The purchase price equates to almost $4 billion, based on closing share prices Wednesday when the deal was announced, noted Enverus Intelligence…

M&A

Articles from M&A

BP, Adnoc East Mediterranean Partnership to Advance Egyptian Natural Gas

Abu Dhabi National Oil Co. (Adnoc) and BP plc are creating a joint venture (JV) focused on Egyptian natural gas production as conflict in Israel and Palestine continues to pressure Eastern Mediterranean energy exports. The new JV, majority-owned by BP (51%), would include the London-based major’s interest in three offshore development concessions, as well as…

Nebula Energy Buys Majority Stake in AG&P LNG to Fast-Track Asian Natural Gas Projects

U.S.-based Nebula Energy LLC has invested $300 million for a majority stake in AG&P Terminals & Logistics Pte Ltd., aka AG&P LNG. The investment firm is expanding its business in the liquefied natural gas and carbon capture and storage sectors with its investment in AG&P, with plans to fast-track infrastructure development across emerging markets in…

Permian Heavyweights Diamondback, Endeavor Joining Forces in $26B Merger

Diamondback Energy Inc. is merging with privately held Endeavor Energy Resources LP to create a Permian Basin juggernaut in a $26 billion cash and stock transaction, the companies said Monday. Upon joining forces, the two Midland, TX-based independents would boast about 830,000 net acres and 816,000 boe/d of combined net production. The merger, expected to…

Santos, Woodside Abandon Potential Merger as Search for More Global LNG Supply Continues

Santos Ltd. and Woodside Energy Group Ltd. have decided not to pursue merger talks that could have created an Australian LNG super giant reportedly worth $52 billion. Both firms disclosed Wednesday that months-long talks had ended without a mutually beneficial deal. Combined, the companies control more than 40 million metric tons/year (mmty) of liquefied natural…

Natural Gas M&A Uptick Said Likely Following Oil-Focused Deal Spree

Upstream mergers and acquisitions (M&A) had a banner year in 2023 in the oil and gas sector, with dealmaking reaching a whopping $192 billion total, according to the latest quarterly tally by Enverus Intelligence Research (EIR). While only $6 billion of those transactions were focused on natural gas, versus $186 billion in deals targeting crude…

Natural Gas E&Ps Grab the Baton for M&A in Early 2024 After Record Year of Permian Deals

Could more natural gas-focused exploration and production (E&P) or midstream transactions be in the works after Chesapeake Energy Corp. and Southwestern Energy Co. agreed to combine into the Lower 48’s largest gas producer? Oil-focused dealmaking powered much of the consolidation in the U.S. oil and gas industry in 2023, with associated gas production riding the…

Talos Expanding Deepwater GOM Holdings with $1.29B Takeover of QuarterNorth

Houston-based Talos Energy Inc. is snapping up QuarterNorth Energy Inc., a privately held U.S. deepwater explorer in the Gulf of Mexico (GOM), as it doubles down to expand its “operational breadth and production profile,” CEO Timothy Duncan said. The $1.29 billion cash-and-stock definitive agreement, announced on Monday, would increase Talos output for 2024 by about…

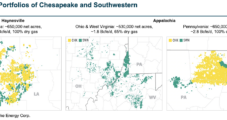

Chesapeake, Southwestern Merger Signals ‘Emerging Confidence’ in Natural Gas Prices

Merging the Lower 48 portfolios of Chesapeake Energy Corp. and Southwestern Energy Co. is set to create the largest natural gas pure-play in the United States, becoming a “must-own” company with the resources to redefine the global energy reach of independent producers. The $7.4 billion combination announced on Thursday was expected, as the tie-up has…

Diversified Selling Appalachian Natural Gas Wells to Holding Company

Diversified Energy Co. plc has sold a sliver of its Appalachian Basin natural gas wells for around $230 million to a holding company to reduce debt, but it said it would continue to operate the assets. The Alabama-based gas producer sold the wells to DP Lion Equity Holdco LLC, with Diversified retaining a 20% minority…