Mexico’s demand for Texan natural gas is set to rise as new infrastructure projects come to fruition.

Along with plans in Mexico to build up to 5 Bcf/d of liquefied natural gas export capacity, state utility Comisión Federal de Electricidad (CFE) also is developing over 7 GW of natural gas-fired power generation by 2025.

These power plants would require an additional 1.1 Bcf/d of natural gas, the CEO of CFE’s natural gas marketing affiliates CFE International LLC and CFEnergía, Miguel Reyes, said during the Mexico Infrastructure Projects Forum in Monterrey, Mexico, last week.

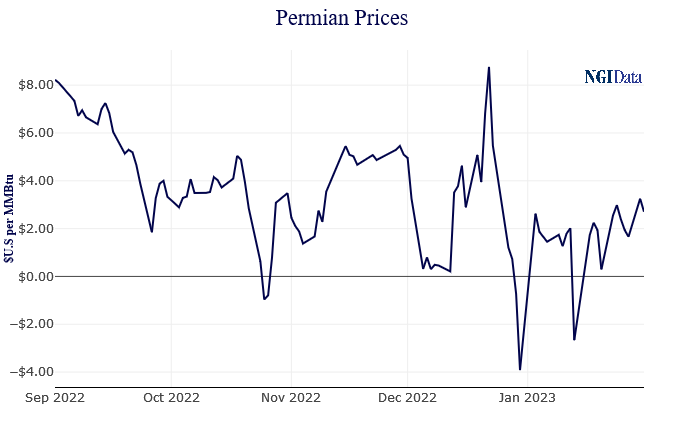

Recently, CFE head Manuel Bartlett called Texan gas “the cheapest gas in the world” and said his company was doing all it could to maximize its usage.

Among other projects, he highlighted...