Markets | E&P | LNG | LNG Insight | Natural Gas Prices | NGI All News Access | NGI The Weekly Gas Market Report | Shale Daily

Tenaska Again Tops U.S. Physical Natural Gas Trading, Followed by BP, Shell, Macquarie and ConocoPhillips

Privately held Tenaska was the No. 1 U.S. natural gas player in the physical markets last year in terms of absolute volumes, according to FERC data.

Omaha-based Tenaska Marketing Ventures captured the top spot for the second year in a row based on the Federal Energy Regulatory Commission’s Form 552. Companies are required to file the forms annually if natural gas sales and/or purchases are more than 2.2 million MMBtu in the reporting year. Information must be detailed about whether the trades were conducted in the day-ahead or bidweek market, as well as how much of the gas was purchased on index versus negotiated prices.

NGI’s Patrick Rau, director of Strategy & Research, conducted a deep dive of the FERC reports submitted as of June 9. Some filings trickle in after the FERC deadline, but “most companies that will file have filed,” he said.

Digging through the data, Rau gleaned some market share and structural information, which he also shared in NGI’s latest Hub & Flow podcast.

Subscribers, to receive NGI’s 2022 FERC 552 dataset with our estimates of parent company rankings, industry classifications and historical data, please contact us at sales@naturalgasintel.com.

That Tenaska was tops “may be a bit of a surprise” to some people, who may have been expecting it to be BP plc. Tenaska, however, is one of the largest natural gas marketing and electric companies in North America. It owns and operates natural gas, solar and wind power plants and provides development services for natural gas-fueled generation, renewable energy, energy storage and carbon sequestration.

London-based BP held the top spot in the Form 552 data between 2009 and 2020. However, in the past two years, BP slipped to No. 2, Rau noted. Shell plc “came in at No. 3 for the second straight year, while Macquarie and ConocoPhillips flip-flopped.” Macquarie moved into the No. 4 position while Houston-based ConocoPhillips dipped to No. 5.

“Interestingly, Tenaska, BP and Shell all maintained their top three spots despite the fact that all three turned in year/year volume declines of between 5% and 7%,” Rau said. “Shell’s 2022 volumes are a bit higher than they were in 2019, but those for BP and Tenaska are down 37% and 13%, respectively, in the last three years. So while the top three are still the same collectively, their share of the market has been falling. It’s been getting a little less top heavy.”

In explaining the data, Rau said some entities “submit a single filing for the entire organization, while others submit entries for each subsidiary.

“For example, Kinder Morgan Inc. filed separate 552 forms for Copano Energy Services, Hiland Partners, their two Texas intrastate pipelines, KM Gas Marketing, Kinetrex, NGPL, Tennessee Gas Pipeline and Scissortail Energy.”

To make “meaningful comparisons across the industry,” however, NGI rolled the individual filings into parent company filings. Overall, Form 552 data included 438 parent companies.

The FERC data also includes natural gas “that has been purchased and sold several times,” he said. “For example, we estimate total sales were 221 Bcf/d in 2022, versus dry gas production of 98 Bcf/d. That would indicate that U.S. production actually cycled or changed hands an average of 2.3 times last year.”

Because of the potential for multiple trades, “and the fact that there are a handful of companies that do not report,” the data should be viewed cautiously, he suggested. To estimate overall market supply and demand figures, “it’s much better to use U.S. Energy Information Administration data for that, in our view.”

In other findings, Williams moved to No. 6 for physical gas sales per the Form 552s, up six notches from 2021. It was the “only new entrant to the Top 10,” Rau noted. “We believe Williams’ rise is mainly the result of their acquisition spree in the last few quarters.”

Rounding out the Top 10 were NextEra Energy Inc. at No. 7, followed by Twin Eagle Resource Management, Koch Industries Inc. and EQT Corp.

The combined market share of the top eight players, “a statistic commonly used in the antirust community, has been in a slow but steady decline over time,” according to Rau. “In 2009, the top eight players had a 31% share, but that was down to 23% in 2022. Similarly, the top 25 players comprised 54% of the market in 2009, but that was just 48% in 2022.”

The Herfindahl-Hirschman Index (HHI), calculated by squaring the market shares of each player and then adding them up was estimated to be only 130.4, according to Rau.

“We believe HHI scores below 1,500 generally indicate a highly competitive market; 130.4 is obviously well below that. Generally speaking, we believe the U.S. natural gas market remains highly fragmented, and that likely won’t do much to slow any upcoming wave of merger and acquisition activity in our industry, particular in the upstream and midstream sectors. There are lots of companies in those spaces that are sitting on large piles of cash.”

Which companies are the largest net buyers and sellers of domestic natural gas also were reviewed by Rau.

“As you can imagine, the top five largest net sellers are all producers,” led by EQT Corp., the No. 1 gas producer in the United States. Chesapeake Energy Corp. was No. 2, followed by Coterra Energy Inc., Antero Resources Resources Corp. and ExxonMobil. EQT, Chesapeake, Coterra and Antero “all have a major presence in the Appalachian region, an area we estimate accounts for roughly one-third of U.S. dry gas production,” he said.

The largest net buyer of domestic gas last year was Mexico’s CFE International, “and that speaks to the growing presence that U.S. natural gas plays in Mexico,” Rau said. Other net buyers all generate electricity, with Southern Company at No. 2, followed by Duke Energy Corp., Exelon Corp., Calpine Corp., NRG Energy Inc. and Vistra Corp.

Coming in at No. 8 of net gas buyers last year was Cheniere Energy Inc., the top LNG exporter in the United States. That was a surprise to some, Rau said. “Cheniere also sells some gas, presumably as a way to balance and optimize all the firm pipeline transportation in their portfolio. But excluding power producers, Cheniere is easily the top buyer of U.S. natural gas.”

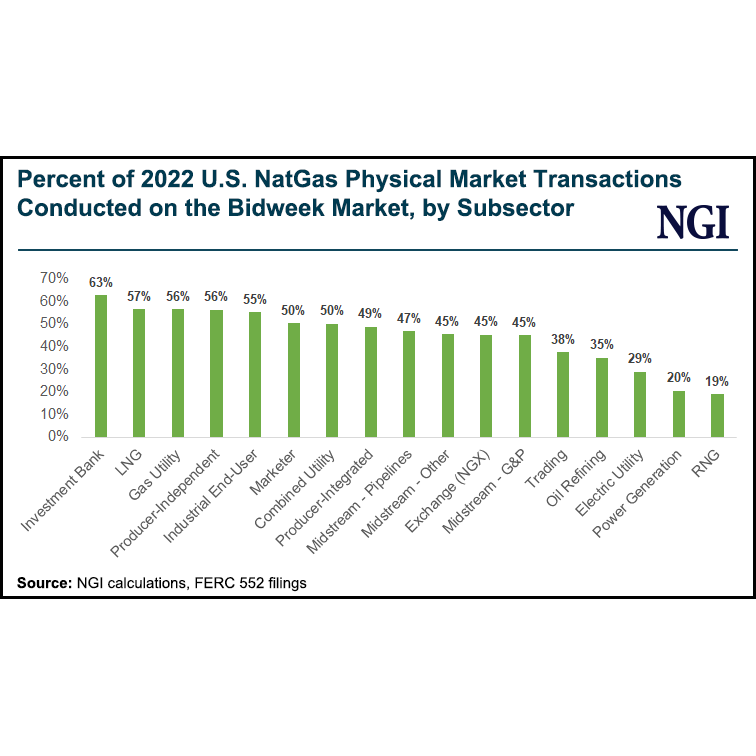

Overall, “83% of physical market gas was purchased on index in 2022, ranging from 96% for oil refiners to 70% for some midstream companies. The day-ahead and bidweek volumes were nearly identical, coming in at 48% and 49% of total volumes, respectively.

“But we note the day-ahead market continues to take share from the monthly market. We believe the growing use of natural gas for electricity generation is the main driver behind that.”

According to NGI calculations, merchant power companies buy 77% of its gas on the day-ahead market while electric utilities buy 70%, “both well above the overall industry average of 48%,” Rau said.

“Investment banks, liquefied natural gas companies, gas utilities, independent producers and industrial end-users tend to transact a greater percentage of their gas on a monthly basis.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |