Infrastructure | LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

Tellurian’s Driftwood LNG Seals Big Supply Pact with India’s Petronet

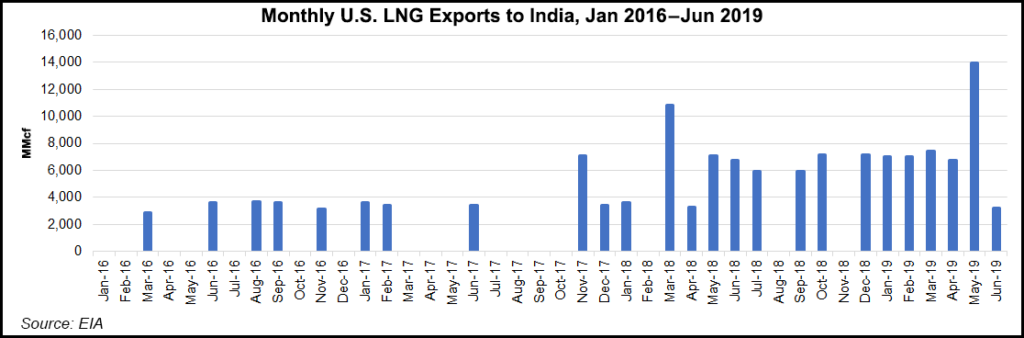

Tellurian Inc. over the weekend took another step toward sanctioning its massive natural gas export project on the Gulf Coast with a proposed agreement to sell a significant portion of capacity to India’s state-owned Petronet LNG Ltd.

A memorandum of understanding (MOU) lays the groundwork for a binding liquefied natural gas (LNG) sales and purchase agreement (SPA) for up to 5 million metric tons/year (mmty) from Driftwood LNG export terminal, which if sanctioned, would be near Lake Charles, LA. Petronet agreed to pay $2.5 billion for an equity stake in the project under the MOU, with another $5 billion that would represent its share of project debt.

Petronet, which supplies around 40% of the gas consumption in India, operates two regasification terminals at Dahej, Gujarat, and Kochi, Kerala.

India Prime Minister Narendra Damodardas Modi, who was in Houston to discuss trade with President Trump, witnessed the signing of the MOU, underscoring the country’s push for economic growth and a cleaner environment.

“Petronet, India’s largest LNG importer, will be able to deliver clean, low-cost and reliable natural gas to India from Driftwood,” Tellurian CEO Meg Gentle said. “Increasing natural gas use will enable India to fuel its impressive economic growth to achieve Prime Minister Modi’s goal of a $5 trillion economy while contributing to a cleaner environment.”

The latest MOU, if it were to be finalized, would replace a deal signed in February and “gives Petronet access to gas on the water at around $3-4/MMBtu, which is a very competitive price,” Tellurian spokeswoman Joi Lecznar told NGI.

The Federal Energy Regulatory Commission authorized the Driftwood LNG terminal and associated 96-mile Driftwood Pipeline in April.

The SPA, expected to be finalized by the end of next March, is one of the final components needed to sanction the 27.6 mmty facility. The company has 4 mmty of capacity left to sell, signaling it could move forward with the first phase of the project, Lecznar said. Tellurian expects to begin construction next year, once a SPA with Petronet is complete, with first LNG expected in 2023.

“This second MOU is a significant step forward in clarifying Petronet’s intended ownership in the Driftwood project in terms of size,” Gentle said.

Total SA in July upped its stake in Driftwood by investing another $500 million in the terminal. The Paris-based oil major also plans to purchase 1 mmty from Driftwood and 1.5 mmty from Tellurian Marketing’s offtake volumes from the facility. Including Total’s original $207 million investment in 2016, the aggregate investment would equal $907 million.

Tellurian also secured an MOU with Vitol Inc. in December to supply 1.5 mmty of LNG for at least 15 years.

Driftwood is one of several second-wave U.S. LNG export projects vying for a projected explosion of global gas demand, led by China, India and other emerging markets. NextDecade Corp. is developing the Rio Grande facility near Brownsville, and Sempra Energy is working to advance its Port Arthur project. Both projects would be sited on the Texas coast.

LNG Ltd. also is proposing the Magnolia terminal that would be close to Driftwood, near Lake Charles, LA. The company last week during Gastech 2019 said it had secured an MOU with Singapore’s Delta Offshore Energy Pte Ltd. to advance a binding SPA for 2 mmty. CEO Greg Vesey indicated that it would need to secure 6 mmty in contracts in order to move forward with the project and that while “2019 is still possible,” that target “could slip into 2020.”

Other executives in Houston last week for Gastech noted the challenges in bringing their projects to fruition, including securing long-term offtake agreements.

NextDecade is now expected to announce a final investment decision by the end of the year, but so far it has inked only one long-term deal, a 2 mmty agreement with a Royal Dutch Shell plc subsidiary. Sempra, meanwhile, signed a heads of agreement with state-owned Saudi Arabia Oil Co. to negotiate buying a 25% stake in Phase 1 of the Port Arthur terminal. Sempra also has a 2 mmty deal in place to supply Poland’s state-owned Polskie Gornictwo Naftowe i Gazownictwo SA, aka PGNIG.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |