Infrastructure | Earnings | NGI All News Access

TC Energy Pushes Back Tula-Villa de Reyes In-Service Date to 2021

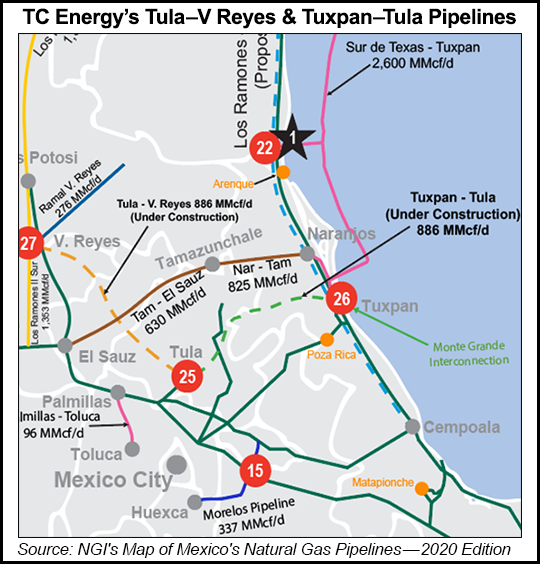

TC Energy Corp. expects the phased entrance into service of the 886 MMcf/d Tula-Villa de Reyes pipeline in Mexico to occur in the first half of 2021.

The delayed pipeline has been further held back by coronavirus contingency measures, which have impeded granting work authorizations because of administrative closures, executives said Thursday during a second quarter earnings call.

The new timetable is subject to the “timely reopening of government agencies,” executives said.

Upon completion, the 261-mile line would connect to TC’s operating Tamazunchale pipeline, and to the Tuxpan-Tula pipeline, whose construction has been held up by a pending indigenous consultation process by Mexican Energy Ministry Sener.

Earlier this year, President Andres Manuel Lopez Obrador said he would ask TC to seek an alternative route for the 56-mile middle section of Tuxpan-Tula, as work has not begun “because the people won’t allow it and in this case, the people are right.”

Both Tuxpan-Tula and Tula-Villa de Reyes are part of a dispute over fixed capacity payments because of force majeure events. Arbitration proceedings over the pipelines are suspended until the fourth quarter while discussions continue with the anchor customer Mexican state utility Comisión Federal de Electricidad (CFE).

“We take a long-term perspective on Mexico,” said COO Francois Poirier during the earnings call. “We think that the growth and introduction of low cost natural gas from the U.S. Gulf Coast into the Mexican economy is a strong strategic imperative for the country. It will be a strong driver of macroeconomic growth going forward and it’s consistent with the Mexican government and the CFE’s ambitions with respect to power generation and its own market share ambitions.”

TC has five pipelines currently generating revenue in Mexico, including the 2.6 Bcf/d marine pipeline from South Texas to Tuxpan which came online last September, all of which are anchored by long-term contracts with CFE.

The TC pipelines in Mexico are part of a vast energy infrastructure buildout in Mexico including cross-border natural gas pipelines that have started to pay dividends for producers of U.S. natural gas.

Despite the coronavirus, during the July 20-24 period, the United States exported nearly 6.4 Bcf/d to Mexico, according to Genscape Inc., marking the strongest five-day period on record.

“North American natural gas markets have been upended this year by a multitude of events, chief among them the plunge in crude oil prices and a dramatic drop in liquefied natural gas exports,” RBN Energy LLC analyst Jason Ferguson said in a note. However, “things are looking up” in Mexico.

“Total exports across the border have reached new highs this month, with just completed infrastructure in Mexico assisting in the jump. Perhaps things are getting back to normal, at least in this small corner of the energy markets.”

As part of the growing importance of the energy relationship with Mexico, following a speech in Midland, TX, on Wednesday President Trump signed Presidential Permits for four energy infrastructure projects, including a “vital pipeline and railway infrastructure” along the U.S.-Mexico border.

One permit granted to NuStar Logistics LP gives permission to operate and maintain the eight-inch diameter, 64,000 b/d Burgos (Dos Paises) pipeline. The system carries petroleum products under the Rio Grande on the Texas border into northern Mexico. Burgos traverses 46.5 miles, connecting a terminal six miles north of Edinburg on the Texas border with the Petróleos Mexicanos (Pemex) Burgos Gas Plant near Reynosa in Tamaulipas, Mexico.

Another permit extends a 2017 authorization to 10 years from five years for NuStar’s New Burgos pipeline. The 10-inch diameter system is designed to move up to 108,000 b/d of petroleum products into Mexico from Texas. The project also would connect to the Pemex terminal near Reynosa.

TC reported net income attributable to common shares of C$1.3 billion ($967 million), or C$1.36/share, for the second quarter, compared with C$1.1 billion, or C$1.21/share, for the same period in 2019.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |