Earnings | NGI All News Access

Talos Maintains Bright Outlook For Private Sector E&P in Mexico Despite Tension

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |

Markets

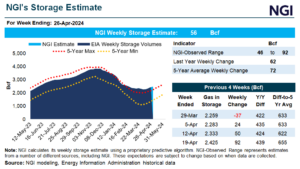

Natural gas futures extended losses on Wednesday as forecasts pointed to benign conditions and LNG demand proved soft, offsetting continued light production estimates and expectations for a seasonally bullish storage print. At A Glance: Unsupportive weather outlook Production hovers near 97 Bcf/d NGI models 56 Bcf storage build Coming off a 3.9-cent decline the prior…

May 1, 2024Natural Gas Prices

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.