Shell Chemical LP is offering to pay western Pennsylvania localities millions for lost tax revenue affected by its proposed “world-scale” ethane cracker. The Beaver County Commissioners said the Royal Dutch Shell plc subsidiary had made an initial proposal to pay localities 110% of the annual property tax revenue currently being paid by Horsehead Holding Corp., which owns the proposed cracker site. State law caps payments-in-lieu-of-taxes at 110%. County tax records show Horsehead, a zinc producer, was assessed around $6.2 million for the 2013 tax year. At 110%, Shell’s offer could amount to an annual payment of about $6.82 million over 22 years, but the county said negotiations are needed. Local stakeholders are preparing to file an application to the state Department of Community and Economic Development for a Keystone Opportunity Expansion Zone for the ethane cracker site. Such a designation would, if approved, give Shell up to 22 years of tax exceptions and abatements.

Western

Articles from Western

Utica Shale Emerging as Possible Triple Threat, Says IHS

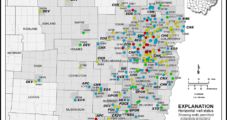

It’s too early in the game to know if the productivity power of the Utica/Point Pleasant Shale in Ohio and western Pennsylvania will match other U.S. unconventional plays, but initial natural gas well data is encouraging, and if the oil-prone window is successfully derisked, the play could prove to be a triple-play hydrocarbon monster, according to IHS Inc. researchers.

Tioga Lateral OK’d, But Alliance Sees More Growth Ahead

Moving natural gas from Western Canada and the Bakken Shale through new and existing pipelines will keep Calgary-based Alliance Pipeline LP as busy as it has ever been in its 12-year history. FERC last Thursday approved the pipeline’s proposal to build a lateral out of the Bakken Shale to Alliance’s mainline, allowing producers to meet the growing gas demand in Chicago.

Bonavista Adds to Canada Deep Basin Natural Gas Inventory

Calgary natural gas producer Bonavista Energy Corp. on Wednesday plans to expand its Western Canadian operations after announcing a deal that would double its land position in the Deep Basin and increase estimated output by 10% through a C$155 million agreement with an undisclosed company.

Crestwood Completes Purchase of Barnett Assets from Devon

Crestwood Midstream Partners Monday said it has completed the acquisition of gathering and processing assets from subsidiaries of Devon Energy Corp. for $87.1 million, which is $2.9 million less than the originally reported acquisition price (see Shale Daily, July 25).

Industry Briefs

Littleton, CO-based American Eagle Energy Corp. expanded its existing carry agreement to accelerate drilling. Last May the company entered into a six-well carry agreement; the amended agreement extends the terms of the financing to an additional four wells, all of which will be drilled in the Bakken or Three Forks zones of its Spyglass Project. “The expansion of our existing carry agreement…allows us to continue aggressively pursuing our development program within the Spyglass Property while minimizing our capital outlay,” said President Brad Colby. The expansion of the scope of the agreement allows American Eagle to contract a second drilling rig to begin drilling infill locations on the Spyglass property. American Eagle expects a second Nabors Drilling rig to arrive by the middle of September and anticipates drilling and completing a total of 12 gross wells (4.2 net) with the two rigs by the end of 2012, including all 10 wells covered by the amended carry agreement.

House Bill Would Further Delay BLM Fracking Rule

Rep. Bill Flores (R-TX) has introduced a bill that would further delay action on the Interior Department’s Bureau of Land Management (BLM) proposed rule governing hydraulic fracturing (fracking) activities on public and Indian lands until Interior Secretary Ken Salazar submits a report examining the effects of the rule.

Mississippian Lime Earning Industry’s Interest, IHS Says

The Mississippian Lime formation, which stretches across northern Oklahoma, western Kansas and southern Nebraska, is drawing increased industry interest, thanks to cheaper drilling costs and shallower wells compared to North Dakota’s Bakken Shale, according to the “IHS Herold Mississippian Oil Play Regional Play Assessment.”

Mississippian Lime Earning Industry’s Interest, IHS Says

The Mississippian Lime formation, which stretches across northern Oklahoma, western Kansas and southern Nebraska, is drawing increased industry interest, thanks to cheaper drilling costs and shallower wells compared to North Dakota’s Bakken Shale, according to the “IHS Herold Mississippian Oil Play Regional Play Assessment.”

Survey Finds Support for Marcellus Drilling in Pittsburgh Area

Residents of Pittsburgh and the 32-county area surrounding it believe drilling for natural gas in the Marcellus Shale is both an economic opportunity for the region and a potential environmental and public health threat, according to the results of a recent survey conducted by PittsburghToday and the staff of the University of Pittsburgh’s University Center for Social and Urban Research.