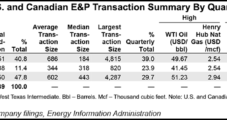

Few mega-deals have hit the oil and gas sector for awhile, but North American oil and gas transactions have accelerated, particularly in the Permian Basin and in Oklahoma, as commodity prices strengthen, the bid/ask spread tightens and capital markets access improves, Fitch Ratings said Thursday.

Tag / Transaction

SubscribeTransaction

Articles from Transaction

Seven Generations Boosting Montney Shale NatGas Focus in C$1.9B Deal With Paramount

Calgary-based Seven Generations Ltd. (7G) on Wednesday struck a C$1.9 billion ($1.47 billion) deal to expand its natural gas opportunities in the Montney Shale in a transaction that also would bring aboard cross-town rival Paramount Resources Ltd. as a 10% stakeholder.

U.S. NatGas, Oil Dealmaking Sluggish as ‘Valuation Gaps’ Hinder Sales

Last year was the slowest in eight years for dealmaking in the U.S. natural gas and oil patch, and tepid sales activity continued through the first quarter, according to researchers.

U.S. NatGas, Oil Dealmaking Sluggish as ‘Valuation Gaps’ Hinder Sales

Last year was the slowest in eight years for dealmaking in the U.S. natural gas and oil patch, and tepid sales activity continued through the first quarter, according to researchers.

Callon Stocking Up in West Texas, Nearly Doubling Permian Running Room

Callon Petroleum Co. said late Tuesday it is acquiring close to 16,000 net acres, 192 net locations and 2,884 boe/d in private transactions that will nearly double its position in the Permian Basin of Texas.

Callon Stocking Up in West Texas, Nearly Doubling Permian Running Room

Callon Petroleum Co. said late Tuesday it is acquiring close to 16,000 net acres, 192 net locations and 2,884 boe/d in private transactions that will nearly double its position in the Permian Basin of Texas.

NGI The Weekly Gas Market Report

Kinder, Brookfield Infrastructure Boosting NGPL Stake

Kinder Morgan Inc. (KMI) and Brookfield Infrastructure Partners LP have agreed to pay $242 million for the 53% equity interest in Natural Gas Pipeline Company of America LLC that they don’t already own.

U.S. Upstream Dealmaking Moves to Sidelines as Midstream Buyers Step Up

An uptick in U.S. midstream dealmaking lifted acquisition activity between April and June, while upstream transactions fell by half from a year ago, a new report by PwC US said.

WPX CEO Says RKI’s Permian Portfolio ‘The Whole Enchilada’

Natural gas producer WPX Energy Inc. on Tuesday agreed to buy RKI Exploration & Production LLC’s Permian Basin operations in a transaction worth $2.75 billion, which would increase liquids reserves by one-third and substantially add to the drilling inventory.

WPX CEO Says RKI’s Permian Portfolio ‘The Whole Enchilada’

Natural gas producer WPX Energy Inc. on Tuesday agreed to buy RKI Exploration & Production LLC’s Permian Basin operations in a transaction worth $2.75 billion…