The U.S. natural gas markets likely face demand growth of more than 14 Bcf/d between now and 2020, and while there appears to a surplus of gas still in the ground, demand may be capped by operators’ ability to deliver supply, Barclays Capital analysts said Monday.

Surplus

Articles from Surplus

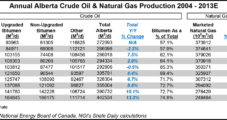

Alberta Fracking New Life Into Oil Production

Horizontal drilling and hydraulic fracturing has powered the biggest increase since the 1970s in Alberta oil production from flowing wells outside the northern bitumen sands belt, says the provincial Energy Resources Conservation Board (ERCB).

Intermountain LNG Facility Flush; Utility Customers Benefit

Idaho regulators have taken steps to make sure local MDU Resources Group utility Intermountain Gas Co.’s current projected surplus of liquefied natural gas (LNG) that is sold to nonutility customers includes benefits for the retail regulated gas utility customers.

Marcellus Liquids Bound for Europe

Marcellus Shale ethane is a long way from the Mont Belvieu, TX, market center, making it the most likely supply to be rejected in times of surplus. But Marcellus producer Range Resources Corp. has an alternative — and a contract — to deliver some of its ethane to Philadelphia for sale to a European petrochemical producer.

Some Range Marcellus Liquids Bound for Europe

Marcellus Shale ethane is a long way from the Mont Belvieu, TX, market center, making it the most likely supply to be rejected in times of surplus. But Marcellus producer Range Resources Corp. has an alternative — and a contract — to deliver some of its ethane to Philadelphia for sale to a European petrochemical producer.

Shale Gas: An Opportunity Wrapped in a Dilemma

Low prices have made dry gas from shales a producers’ problem and an end-user’s dream. But interests at both ends of the market do agree that the right gas price — the equilibrium price — would make shale gas a boon for the country.

ConocoPhillips Exec: Gas Oversupply Situation Overstated

Although a shale-produced natural gas surplus remains, it is at a lower level than many expected and thus a couple of drivers could send prices back into a period of volatility, according to Jim Duncan, chief analyst and commodity market strategist for ConocoPhillips in Houston.

Beware! Gas Price Volatility May Return, ConocoPhillips Exec Says

Although a shale-produced natural gas surplus remains, it is at a lower level than many expected and thus a couple of drivers could send prices back into a period of volatility, according to Jim Duncan, chief analyst and commodity market strategist for ConocoPhillips in Houston.

Marcellus Shale Coalition Sees Vindication in EIA, USGS Data

Production data issued by the Energy Information Administration (EIA) Tuesday — which indicated that increased drilling in the Marcellus Shale has been the leading force in the growth of natural gas production in the northeastern United States — combined with a recent U.S. Geological Survey (USGS) report, demonstrates that the Marcellus Shale is hardly the shrinking violet some mainstream media reports have claimed, according to the Marcellus Shale Coalition (MSC).

Pennsylvania Congressman Favors Exporting Shale Gas

Rep. Glenn “GT” Thompson (R-PA) said he supports exporting surplus Marcellus Shale gas to China and other countries that do not have free trade agreements with the U.S., and also backs the concept of exporting liquefied natural gas (LNG) from a port in Maryland.