Capacity to move growing production of condensate and natural gasoline out of the Marcellus/Utica Shale region to diluent markets in Canada is being offered by Unity Pipeline Co. LLC, which is proposing a system of new pipeline, as well as pipeline to be converted from natural gas service.

NYMEX

Articles from NYMEX

Phillips 66 to Add LPG Export Terminal at Freeport Facility

Phillips 66 is planning to expand its midstream business with a liquefied petroleum gas (LPG) export terminal to be built at its existing marine terminal in Freeport, TX, the Houston-based company said.

The Frackers Tells of Risky, Ambitious Ride to Energy Independence

George P. Mitchell and crew long have been credited with finding the trigger to unlock unconventional natural gas, but it was in fact a colorful cast of visionaries, oddballs and take-no-prisoner pitchmen who helped launch the United States on the road to energy independence, as told in the insightful, and at times suspenseful, new book by bestselling author Gregory Zuckerman, The Frackers: The Outrageous Inside Story of the New Billionaire Wildcatters.

CPUC Regulator Accuses PG&E of ‘Dishonesty,’ Calls for $17.25M Fine

Within days of a regulatory judge’s recommending a lesser penalty, one of the five members of the California Public Utilities Commission (CPUC) late Monday issued an alternate proposed decision, slapping a $17.25 million fine on Pacific Gas and Electric Co. (PG&E) for “calculated dishonesty” related to a natural gas pipeline safety issue.

Encana to Sell, Spin Off Properties, Slash Jobs

Encana Corp. on Tuesday announced a bold strategy to move back into the winning column by focusing on only five North American onshore plays — down from 30 — requiring leasehold sales, a spinoff and a 20% reduction in jobs. The goal is to balance liquids and natural gas by 2017 from a limited number of assets, said CEO Doug Suttles.

Wyoming Lawmakers to Study Taking Back Federal Lands

An interim state legislative task force in Wyoming has directed staff to compile a report for two committees assessing the prospects for the state attempting to take back federally managed public lands, possibly following a tack Utah took last year. Any federal-to-state transfer of land control would be applauded by the oil and natural gas industry as drilling permits historically have taken exponentially longer to receive from the federal government.

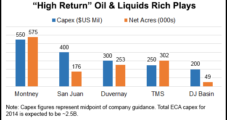

Encana’s Top Five Money Makers Getting Bulk of Budget

Encana Corp., in stress mode since natural gas prices collapsed in 2009, will spend 75% of 2014 capital on only five North American onshore plays, all oily and liquids-rich, a strategy that within four years is designed to create a more evenly balanced operator.

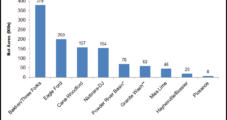

Marathon Oil Eagle Ford Retention Drilling Mostly Done

Marathon Oil Corp. continued to raise its game in the Eagle Ford Shale during the third quarter, improving drilling times by 20% from a year ago and bringing drilling and completion costs down by 20%. The company still plans to exit the year with net production of about 100,000 boe/d from the South Texas play.

MSC, PIOGA to Study Radioactive Materials From Drilling

The Marcellus Shale Coalition (MSC) and the Pennsylvania Independent Oil and Gas Association (PIOGA) will study radioactive materials produced from shale development activities, with the results intended to complement a similar study being performed by state regulators, the groups said.

East Coast, West Coast Strength Can’t Offset Overall Weakness; Futures Sacked For A Loss

The price being paid Monday for Tuesday physical natural gas delivery on average lost 2 cents as major hubs were mixed, but firm pricing on the West Coast and Eastern Seaboard was not able to offset weakness at Gulf and interior locations. At the close of futures trading, December had fallen 6.8 cents to $3.445 and January skidded 6.7 cents tp $3.524. December crude oil added a penny to $94.62/bbl.