Natural gas futures extended their losses for a third straight day as weather models continue to portray a pattern that is more reflective of springtime conditions than winter. After shedding more than 90 cents over the previous two sessions, the January Nymex gas futures contract plunged another 30.9 cents to settle at $4.258/MMBtu. Spot gas…

Tag / natural gas exports

Subscribenatural gas exports

Articles from natural gas exports

Pembina Scraps Plans for Jordan Cove LNG in Oregon After Years of Setbacks

Pembina Pipeline Corp. is abandoning plans to build a liquefied natural gas (LNG) export project and related pipeline in Oregon, citing ongoing regulatory setbacks in a filing with federal regulators on Wednesday. “Despite diligent and persistent efforts, Applicants have not been able to obtain the necessary state-issued permits and authorizations from various Oregon state agencies,”…

January Natural Gas Prices Extend Losing Streak as Demand Fades

Natural gas futures tumbled further on Tuesday as traders looked past robust demand for U.S. exports and fixated on exceptionally light domestic weather demand expectations heading into December. The January Nymex contract dropped 28.7 cents day/day and settled at $4.567/MMBtu. February fell 26.2 cents to $4.506. At A Glance: Forecasters call for warm December Production…

Mild Weather, Omicron Variant Heap Downward Pressure on Natural Gas Futures

Natural gas futures nosedived on Monday on forecasts for benign weather into December and worries about the possible effects of a new coronavirus variant on energy demand. At A Glance: Futures flop as new prompt month takes over Weather forecasts point to modest demand Cash prices drop in the Rockies, West The January Nymex contract,…

January Natural Gas Down After December Expiry; Forecasts Show Warmer Shift

Natural gas futures were off sharply in early trading Monday, erasing gains recorded alongside front-month expiration late last week as analysts pointed to warming forecasts and weaker fundamentals. The January Nymex contract was down 51.5 cents to $4.962/MMBtu at around 8:40 a.m. ET. The December contract rolled off the board on Friday with a 37.9-cent…

Natural Gas Futures Rebound, Fueled by Export Demand Strength

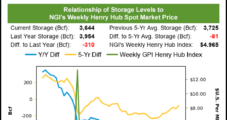

Natural gas futures forged higher on Tuesday, recovering much of the ground lost a day earlier, as markets shifted attention to European supply woes and expectations for robust demand for U.S. exports of liquefied natural gas (LNG) through winter. At A Glance: BREAKING: U.S. EIA reports withdrawal of 21 Bcf for week ending Nov. 19…

December Natural Gas Futures Soar Along with LNG Demand

Natural gas futures on Friday rallied for the fourth time in the week’s five trading sessions, lifted by ongoing robust levels of U.S. exports and expectations for stronger weather-driven demand in coming weeks. The December Nymex contract gained 16.3 cents day/day and settled at $5.065/MMBtu. January rose 15.0 cents to $5.145. At A Glance: U.S.…

Natural Gas Prices Rally Again, with December Futures Finishing Strong Week on High Note

Natural gas futures on Friday rallied for the fourth time in the week’s five trading sessions, lifted by ongoing robust levels of U.S. exports and expectations for stronger weather-driven demand in coming weeks. The December Nymex contract gained 16.3 cents day/day and settled at $5.065/MMBtu. January rose 15.0 cents to $5.145. At A Glance: Futures…

With Export Demand Holding Strong, Natural Gas Futures Post Solid Gain

Natural gas futures vaulted higher on Thursday as production eased, export demand jumped and traders looked ahead to colder weather and the onset of winter storage withdrawals. The December Nymex contract rose 8.6 cents day/day and settled at $4.902/MMBtu. January added 8.1 cents to $4.995. At A Glance: U.S. LNG volumes gain momentum EIA prints…

December Natural Gas Futures, Spot Prices Sputter

Natural gas futures careened on Wednesday amid profit-taking and expectations for a relatively plump storage increase for mid-November. The December Nymex contract dropped 36.1 cents day/day and settled at $4.816/MMBtu. January fell 35.6 cents to $4.914. At A Glance: BREAKING: U.S. EIA on Thursday reported an injection of 26 Bcf natural gas into storage for…