Natural Gas Prices | Mexico | NGI All News Access

Natural Gas Futures Sink Further as Forecasts Hint Warmth Could Linger Through Late December

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |

Markets

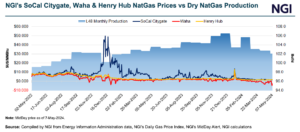

Natural gas futures on Tuesday notched a fourth-straight day of gains – albeit barely – on maintenance-induced reductions to already lower production activity. At A Glance: Production hits May low Weather forecasts mixed LNG steadies above 12 Bcf/d Coming off a cumulative gain of more than 25 cents over the prior three sessions, the June…

May 7, 2024Earnings

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.