Goodrich Petroleum Corp. said it encountered a problem during hydraulic fracturing (fracking) operations at a well in the Tuscaloosa Marine Shale (TMS) in Mississippi, but it is moving forward with two additional wells targeting the play.

Tag / natural gas data

Subscribenatural gas data

Articles from natural gas data

Aftermath of PA Act 13 Ruling: Widespread Uncertainty

As a clearer picture emerges from the Pennsylvania Supreme Court’s recent ruling that struck down key provisions of the state’s most comprehensive oil and gas legislation, the court’s decision is likely to have repercussions for a decade or more, sources say, with the impact extending across the spectrum and touching more than just the pace of the industry’s operations in the Marcellus Shale.

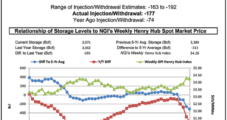

Cash Holds, But Futures Traders See $4.60 Gas

Deliveries of weekend and Monday gas were unchanged on average in Friday’s trading, with eastern and Northeast weakness for the most part offset by gains in the Midwest. At the close, January had fallen 2.6 cents to $4.407 and February was down 10.8 cents tgo $4.368. February crude oil added 77 cents, to $100.32/bbl, the first time oil has traded above $100 in two months.

Weekly Gains Send Chicago Citygate To 2 1/2 Year High

At first glance weekly gas prices were kind to neither the bulls nor the bears. For the week ended Dec. 27 the NGI National Weekly Spot Gas Average fell by just a penny to $4.47, but major swings were recorded throughout the country. Chicago Citygate bulls enjoyed the highest NGI weekly price in 2 1/2 years at $4.81. Of the actively traded points the Northeast was home to market points showing the greatest gains as wellas losses. In New England Iroquois Zone 1 recorded the largest advance rising 81 cents to $5.77, and at the other end of the spectrum deliveries to Algonquin Citygates tumbled $4.41 to $9.75.

People

Freeport-McMoRan Copper & Gold Inc.CEO and Vice Chairman Richard Adkerson, 66, has been awarded shares currently valued at about $36 million as compensation for canceling severance pay rights, part of a makeover in executive compensation at the company. Adkerson, CEO of the Phoenix operator since late 2003, signed an employment contract in 2008 that would have given him the right to payments of about $49 million for being fired or $60.8 million following a change of control. In June, Freeport completed a $9 billion cash/stock purchase of Plains Exploration & Production Co. and McMoRan Exploration Co. (see Daily GPI, June 4; Dec. 6, 2012). Plains chief Jim Flores was named vice chairman, part of an “office of the chairman” to include Adkerson and Chairman Jim Bob Moffett. Freeport has been revising its compensation policies following criticism by shareholders, which twice have rejected executive pay practices on nonbinding votes. The “say on pay” vote was rejected by 71% this year.

Broad Weakness Outdoes New England Strength; Futures Ease Higher

Physical gas for Friday delivery slipped a few cents Thursday as outsized gains at New England points could not offset broader losses in the Midwest, Gulf Coast and California.

Louisiana Adds Potential Ethane Cracker to Its Gas-Inspired Building Boom

Axiall Corp. has chosen Louisiana as the site for a potential world-scale ethane cracker that would be built by the company and a joint venture partner in conjunction with a related ethylene derivatives plant.

Cash Weakens; Futures Trader Sees Selling Opportunity

Physical natural gas for delivery Wednesday and Thursday overall fell sharply in Tuesday’s trading as traders scaled back purchases ahead of the Christmas holiday, though much of the decline came at four capacity-constrained points in New England.

People

Los Angeles-based Occidental Petroleum Corp. (Oxy) said it is paying a $14 million lump sum to former chairman and CEO Ray Irani as part of a $26 million settlement following his ouster earlier this year from chairing the Oxy board. After a 30-year stint at the mid-major oil/natural gas company, Irani, 78, was pushed out of his chairman role in May (see Daily GPI,May 6). Occidental said in a regulatory filing that Irani will get lifetime security and financial planning services estimated at up to $1.3 million annually. The former executive was paid an average of $90 million annually in total compensation during the past 11 years, according to a calculation by the Los Angeles Times. Initial comments from Wall Street analysts characterized the exit package for the former executive as excessive.

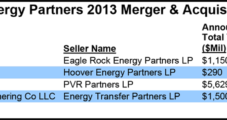

Regency Building Texas Presence with Two Deals Worth $1.6B

Regency Energy Partners LP is picking up the midstream business of Eagle Rock Energy Partners LP in a $1.3 billion deal. Combined with Regency’s planned acquisition of PVR Resources, the Eagle Rock assets will diversify its exposure in East and South Texas as well as the Texas Panhandle. A smaller deal, also announced Monday, aims to grow Regency’s presence in the Delaware Basin in West Texas.