Historic flooding that took its toll in the heart of Colorado oil and natural gas production in the Denver-Julesburg Basin last September (see Shale Daily, Oct. 10, 2013) will be the subject of a half-day workshop Thursday afternoon hosted by the state’s Oil and Gas Conservation Commission (OGCC) to discuss “lessons learned” and whether new policies and rules are needed. Record-breaking floods along the Front Range and eastern plain in September inundated oil and gas operations near streams, damaging production facilities and producing spills of oil, condensate and produced water, according to OGCC. Colorado Oil and Gas Association CEO Tisha Schuller is expected to make a presentation at the workshop.

Tag / natural gas data

Subscribenatural gas data

Articles from natural gas data

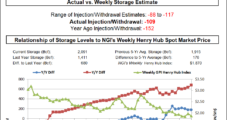

NatGas Futures Return to Orbit; 230 Bcf Draw Inline With Expectations

Backing off Wednesday’s round of over-exuberant short-covering that saw both February and March futures soar by 52.4 cents, the newly minted front-month contract was in full retreat Thursday as the current polar vortex eased and forward-looking weather forecasts also moderated.

PDC Boosts Reserves in Appalachia, Colorado

PDC Energy Inc.’s total proved reserves went from 193 million boe in 2012 to 266 million boe last year, a record increase thanks in large part to its assets in Colorado and Ohio, where the company continues to focus on liquids production.

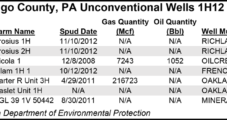

Court Rules Seneca Holds Oil, Gas Rights on Pennsylvania Game Land

A court in Pennsylvania ruled Monday that Seneca Resources Corp. owns the rights to oil and natural gas under about 3,650 acres in Venango County owned by the state Game Commission (PGC), but it said it was unclear whether the company also had the right to perform hydraulic fracturing (fracking) on some of the acreage.

Appalachia Midstream Companies Focused on Storage, Expanded Markets

Amid one of the coldest winters in 35 years and basis blowouts in recent weeks that recently drove the price of natural gas to unprecedented numbers, midstream companies are focused not just on new infrastructure, but more storage, and above all, more market outlets for producers, executives said Wednesday.

Marathon Petroleum Plans More Investments in U.S. Crude Midstream, Retail

Marathon Petroleum Corp. (MPC) announced Wednesday it would invest more in its midstream and retail segments over the next three years to take advantage of growing North American crude oil markets.

McClendon Secures More Funding to Pursue Onshore Acquisitions

An affiliate of Aubrey McClendon’s American Energy Partners LP has up to $500 million in private equity (PE) commitments to pursue working stakes in “various onshore basins,” the producer said Wednesday.

Texas Ended 2013 With Another Upstream Activity Record

The Texas upstream energy industry — oil and gas, but mostly oil — had one of its most successful years last year, according to industry barometer the Texas Petro Index (TPI).

Hess to Sell Utica Dry Gas Acreage for $924M

Hess Corp. announced Wednesday that it plans to sell about 74,000 acres in the Utica Shale, classified as dry natural gas acreage, to an undisclosed buyer for $924 million.

Industry Brief

The Federal Energy Regulatory Commission (FERC) has authorized the transfer of certain natural gas distribution facilities in Kansas, Oklahoma and Texas from Oneok Inc. to ONE Gas Inc. as part of a company reorganization (CP13-550-000). The FERC order came three weeks after the board of directors on Wednesday unanimously approved the separation of the company’s natural gas distribution business into ONE Gas, a stand-alone, publicly traded company (see Daily GPI, Jan. 8). ONE Gas would consist of Kansas Gas Service, Oklahoma Natural Gas Co. and Texas Gas Service, and be headquartered in Tulsa. It would be one of the largest natural gas utilities in the United States, serving more than two million customers in three states, and a 100% regulated, publicly traded natural gas utility. The plan to spin off the utility business was announced in 2013 (see Daily GPI, July 26, 2013). ONE Gas common stock is expected to begin “regular-way” trading on the New York Stock Exchange (NYSE) on Monday (Feb. 3) under the symbol “OGS.”