Lucid Energy Group LLChas finalized a $200 million revolving credit facility that will support growth in the Permian Basin. Together with private equity commitments from EnCap Flatrock Midstream and management, the credit facility provides Lucid with $425 million in available financing. Lucid increased its capital sources to support expansion of its pipeline gathering system and natural gas processing facilities in West Texas, which serve production from the Midland Basin’s Wolfcamp and Cline shales. Lucid’s system includes more than 300 miles of high- and low-pressure pipeline delivering liquids-rich natural gas to two separate cryogenic processing complexes in Sterling and Irion counties. The company has commissioned a third cryogenic processing plant and a nitrogen rejection plant in Sterling County. The new plant will bring Lucid’s processing capacity to 120 MMcf/d. Acreage dedications to Lucid exceed 800,000 acres across an eight-county area of the Midland Basin and include Wolfcamp Shale production centered in Irion, Reagan and Crockett counties and Cline Shale production centered in Sterling County.

Tag / natural gas data

Subscribenatural gas data

Articles from natural gas data

Midwest Prices Skyrocket as Buyers Stock Up for Weekend

Spot prices for gas for delivery for the weekend and Monday vaulted higher Friday, led by gains in the Midwest and Great Lakes. Buyers were scrambling for supplies as weather-driven prices on pipelines serving the frozen tundra of Minnesota, Wisconsin and Michigan posted double-digit dollar gains.

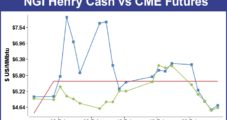

Weekly Traders Hit Hard With Futures, Physical Price Volatility

It was a week of gut-wrenching price changes for both futures and physical natural gas traders. The March futures contract expired Wednesday at a “reasonable” $4.855, but just two days prior, it had traded as high as $6.493 before falling into a tailspin and losing 69.0 cents on the day and finishing at $5.445 Monday. Tuesday’s and Wednesday’s trading added cumulative losses of another 59.0 cents — a 21% drop over three days — and any March futures bulls left standing limped off into the cold and snow to shore up margin accounts.

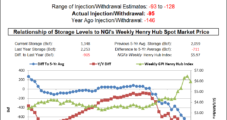

Traders Unfazed by Bearish Storage Stats

Physical natural gas prices for Friday delivery were broadly mixed in Thursday trading, with gains posted in New England, California and the Rockies and declines seen in the Midwest, East and Gulf.

DOT Emergency Order Requires Rail Carriers Test Crude

Rail carriers must test crude oil to ensure that it is properly classified before transport, and are prohibited from using the weakest packing classification for crude, under an emergency order issued by the U.S. Department of Transportation (DOT).

Tenaska Picking Up Gavilon Gas Marketing

Gavilon LLC and Tenaska Marketing Ventures, jointly are seeking waivers from FERC to allow completion of a deal selling Gavilon’s wholesale gas marketing business, including transportation and storage contracts, to Tenaska.

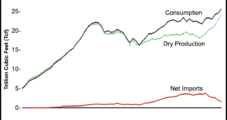

November Natural Gas Production Pushes U.S. Total Near Record High

U.S. natural gas production was 2.56 Tcf in November, up from 2.47 Tcf in November 2012, and was on pace to set a record high for all of 2013, according to the Energy Information Administration’s (EIA) latest Monthly Energy Review (MER).

Long-Drawn Winter Sends Most Natural Gas Storage Estimates Below 1 Tcf

The recent winter price rally was the headline-grabber, but the real news is summer 2015 contracts being sold off, possibly reflecting a forecast for a softer natural gas balance in a year, according to Goldman Sachs.

New Chesapeake Mantra: Optimize, Optimize, Optimize

Chesapeake Energy Corp. is making solid headway in reducing its well costs, with each specific play scrutinized by one team to improve across-the-board metrics, CEO Doug Lawler said Wednesday.

IPAA Says Draft Tax Reform Act Could Harm Producers

Responding to House Ways and Means Committee Chair Dave Camp’s (R-MI) tax reform proposal released Wednesday, an oil and gas group said that while they support some provisions, there are others that could negatively impact producers, royalty owners and the country’s ability to keep up with domestic oil and gas demand.