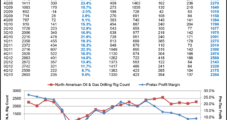

No. 3 oilfield services provider Baker Hughes Inc. on Friday reported a 30% drop in first quarter profits, stung by weak North American drilling, its biggest market. Schlumberger Ltd., the world’s largest oilfield services operator, also reported a drop in quarterly profits on declines in North America, and management said the outlook for the United States and Canada this year remains uncertain.

Multi

Articles from Multi

Trunkline Gas-to-Oil Pipe Conversion Gets Environmental OK

FERC Monday issued a favorable environmental assessment (EA) of Trunkline Gas Co.’s proposal to convert a multi-state natural gas pipeline to crude oil service for the Gulf Coast market.

Northeast Plunge Leads Broad Retreat; Futures Slip Again

The cash market overall retreated 28 cents Wednesday, but if multi-dollar swan dives taken by Northeast and other thinly traded points are excluded, the drop comes to a more meaningful 11 cents. Nearly all points sustained sizeable losses. Midcontinent and California locations were down by double digits, but Gulf points also weakened. At the close of futures trading May had fallen 6.9 cents to $3.900 and June was off by 6.9 cents as well to $3.950. May crude oil plunged $2.74 to $94.45 on unsupportive inventory data and weak economic news.

Northeast Gains Mask Overall Weakness; Futures Rally Off Lows

Physical natural gas prices fell an average 3 cents overall in Monday’s trading, but that hid a much broader and deeper market decline. If multi-dollar advances on volatile Northeast pipelines are factored out, the market decline was just shy of 16 cents. Offsetting the Northeast strength were stout losses at California and Rocky Mountain points. After a weak open, May natural gas futures trimmed losses to nine-tenths of a cent to $4.015 and June eased five-tenths of a cent to $4.061. May crude oil fell 16 cents to $97.07/bbl.

NatGas, Electric Coordination Critical, MISO Exec Says

Facing the prospect of historically high levels of power generation retrofits and replacement, the multi-state Midwest Independent System Operator (MISO) has identified the need for closer coordination with the region’s natural gas system, an executive told a recent House Energy and Commerce subcommittee hearing.

Cooler Temps Keep Cash Market Well Bid; Futures Flounder

The physical market overall was unchanged Thursday, but that was due in large part to multi-dollar losses at constrained northeast pipelines such as Algonquin, Iroquois and portions of Tennessee. Omitting those losses from the equation results in a 6-cent market gain.

Optimism for Texas Petrochem Cracker, Says ExxonMobil

Backed by a plethora of natural gas supplies from its upstream business, ExxonMobil Chemical Co.’s multi-billion-dollar plan to expand its Baytown, TX, petrochemicals complex is on track, an executive said last week at the IHS CERAWeek 2013 conference in Houston.

ExxonMobil Optimistic on Texas Petrochemical Cracker Project

Backed by a plethora of natural gas supplies from its upstream business, ExxonMobil Chemical Co.’s multi-billion-dollar plan to expand its Baytown, TX, petrochemicals complex is on track, an executive said Tuesday at the IHS CERAWeek 2013 conference in Houston.

Industry Briefs

Merchant Energy Holdings LLC is holding a nonbinding open season through Feb. 20 for up to 8 Bcf of firm, high-deliverability, multi-cycle working gas storage capacity available April 1 at its ECGS facility in Logan County, CO, about 90 miles east of the Cheyenne Hub. ECGS began operation in April and is completing its second phase of expansion, which includes additional injection/withdrawal wells, gathering and processing facilities and gas compression. ECGS is connected with Trailblazer Pipeline and has access to other major pipelines at the Cheyenne Hub. Total injection and withdrawal capability after the expansion will be more than 200,000 Dth/d. For information, visit www.mehllc.com or contact Scott Smith, (713) 403-6472, ssmith@mehllc.com; or Kevin Legg, (720) 351-4004, klegg@mehllc.com.

Most Points Higher; Futures Fail To Keep Pace

Physical gas prices continued to advance Wednesday, posting an average gain of 12 cents overall. Multi-dollar gains permeated eastern delivery points, and Midwest locations also were firm. At the close of trading February futures had slipped 2.0 cents to $3.435 and March was down 1.6 cents to $3.437. February crude oil added 96 cents to $94.24/bbl.