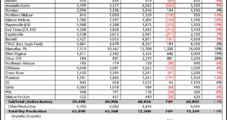

Jefferies LLC has revised its U.S. natural gas price forecast slightly higher for 2017, but associated gas output, swelling from the active Permian Basin, should pressure 2018 prices, analysts said.

Jefferies

Articles from Jefferies

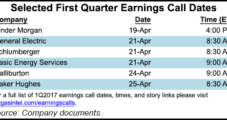

E&P, OFS Sectors Coming on Strong in First Quarter

Winter is over for the long-distressed energy sector in North America, with upstream operators and service companies likely to have more spring in their steps as they offer up first quarter results.

NGI The Weekly Gas Market Report

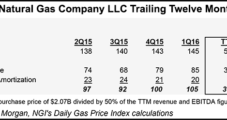

Southern Company Buying Half of Southern Natural Gas System From Kinder

Southern Company is acquiring a 50% equity interest in the Southern Natural Gas (SNG) pipeline system from Kinder Morgan Inc. (KMI). The joint venture (JV) partners plan to “pursue specific growth opportunities” to develop natural gas infrastructure.

U.S. NatGas Prices to Struggle Until Supplies Stall, Says Jefferies

Near-term domestic natural gas prices may struggle to gain momentum this year until there’s more evidence of stalling supply later this year, according to Jefferies LLC.

ZaZa Energy, Hess End Eagle Ford and France JV

ZaZa Energy Corp. and Hess Corp. have ended a joint venture (JV) agreement they made in 2010 for activities in the Eagle Ford Shale in South Texas and the Paris Basin in France. ZaZa is taking over the Eagle Ford activities while Hess will hold the exploration licenses in France.

Talisman Sells Sasol Additional Montney Stake

Calgary-based Talisman Energy Inc. on Tuesday deepened its strategic relationship with Sasol Ltd. by selling it a half-stake in its Cypress A assets in the Montney Shale for C$1.05 billion.

Another International Heavyweight Buys Into U.S. Shales

Australian energy giant BHP Billiton Petroleum has become the latest international energy heavyweight to buy into U.S. shale plays with a transaction to acquire Chesapeake Energy Corp.’s Fayetteville Shale portfolio for $4.75 billion cash.

Chesapeake CFO to Head Fracking Company

Chesapeake Energy Corp.’s original chief financial officer is resigning to run a hydraulic fracturing services company in which the producer holds a 26% stake.

Chesapeake Strikes $1.15B VPP Deal in Barnett Shale

Chesapeake Energy Corp. has sold a five-year volumetric production payment (VPP) to an affiliate of Barclays Bank PLC for proceeds of $1.15 billion related to its production from the Barnett Shale of North Texas, the company said Monday.