The Delaware Court of Chancery has granted a motion by The Williams Companies Inc. to expedite litigation it initiated against Energy Transfer Equity LP (ETE), which challenges a private offering of Series A Convertible Preferred Units that ETE disclosed on March 9. Williams sued ETE and CEO Kelcy Warren, in two separate lawsuits, over the matter earlier this month (see Daily GPI,April 6). The litigation against ETE seeks to unwind the private offering. The litigation against Warren, in the district court of Dallas County, TX, is for wrongful interference, through the private offering, with a merger agreement executed in September 2015 (see Daily GPI,Sept. 28, 2015). The Williams board still supports the merger, the company said.

Hills

Articles from Hills

Black Hills Narrows E&P Focus to Utility Reserves Program

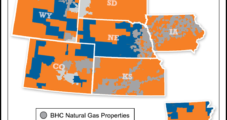

With poor results from its exploration and production (E&P) business, Rapid City, SD-based Black Hills Corp. officials said Wednesday the company is narrowing exploration activity to the proposed cost-of-service natural gas reserves programs to serve its utilities (see Daily GPI,Oct. 5, 2015).

Arkansas OKs Black Hills’ SourceGas Utility Buy

Arkansas regulators have approved Black Hills Corp.’s acquisition of SourceGas Holding LLC’s natural gas utility in South Dakota as part of $1.89 billion, four-state deal announced last summer.

NGI The Weekly Gas Market Report

Spectra, Phillips 66 Bolster DCP Midstream in Cash And Asset Deal Valued at $3B

Six weeks after unveiling a plan to help DCP Midstream LLC (DCP) weather low commodity prices, Spectra Energy Corp. has agreed to acquire a one-third stake in two natural gas liquids (NGL) pipelines from its master limited partnership, while Phillips 66 (PSX) has agreed to contribute $1.5 billion in cash to DCP.

More Impairments Coming For Black Hills E&P Unit, But Mancos Still Eyed

Rapid City, SD-based Black Hills Corp. senior executives told a gathering of Wall Street analysts Thursday that more impairment charges are coming from the impact of depressed crude oil prices on the company’s exploration and production (E&P) operations.

Black Hills’ $1.89B SourceGas Purchase to Add 425,000 NatGas Utility Customers

In a deal that will more than double its utility customers in eight states adding an opportunity to expand its program of providing reserves for ratepayers from its exploration and production (E&P) segment, Rapid City, SD-based Black Hills Corp. has agreed to acquire SourceGas Holding LLC for $1.89 billion.

NGI The Weekly Gas Market Report

Black Hills’ $1.89B SourceGas Purchase to Add 425,000 NatGas Utility Customers

In a deal that will more than double its utility customers in eight states adding an opportunity to expand its program of providing reserves for ratepayers from its exploration and production (E&P) segment, Rapid City, SD-based Black Hills Corp. has agreed to acquire SourceGas Holding LLC for $1.89 billion.

Phillips 66 Partners Midstream Deal Valued at $1B

Phillips 66 Partners LP (PSXP) has agreed to acquire equity interests in three pipeline systems from its general partner, Phillips 66 (PSX), in a transaction valued at more than $1 billion.

Black Hills Pursuing Utility NatGas Reserve Program Via E&P Unit

Rapid City, SD-based Black Hills Corp. is developing a program for some of its utilities in seven states to initiate ratepayer purchases of natural gas reserves from its exploration and production (E&P) segment.

Black Hills Seeing More Red in Oil, Gas Operations

Even with some robust quarter-over-quarter production growth, particularly in crude oil and natural gas liquids (NGL), Rapid City, SD-based Black Hills Corp.’s oil/natural gas operations continued to operate in the red, reporting small losses Wednesday for both the 2Q2014 and first half of the year.