CenterPoint Energy Inc., OGE Energy Corp. and ArcLight Capital Partners are forming a midstream master limited partnership (MLP) that will start off with 8,400 miles of interstate and 2,300 miles of intrastate pipelines in Oklahoma, Arkansas, Texas and Louisiana, plus some other assets.

Equity

Articles from Equity

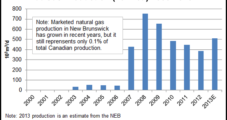

Goldboro LNG Terminal Would Tap Frederick Brook Shale

Contact Exploration Inc. and Pieridae Energy Ltd. have created Pieridae Production LP (PPLP) to focus on natural gas exploration and production in support of Pieridae’s proposed Goldboro LNG Terminal in Guysborough, Nova Scotia. PPLP, which, at least initially, will rely on shale gas in the Frederick Brook Shale.

Deepwater GOM Ventures Targeted by Private Equity

Private equity (PE) upstream investor Ridgewood Energy Corp. is partnering with a fund managed by Riverstone Holdings LLC to invest more than $550 million in a series of deepwater exploration projects in the Gulf of Mexico (GOM).

Tradition Secures Midstream Financing

Tradition Midstream LLC said it has secured $100 million in equity financing to develop infrastructure across North America, with an initial focus on unconventional plays in Texas, Oklahoma and Louisiana.

Chevron, Apache Become British Columbia Partners

Chevron Corp. subsidiary Chevron Canada Ltd. will acquire a 50% operating interest in the Kitimat, British Columbia (BC), liquefied natural gas (LNG) export project and proposed Pacific Trail Pipeline (PTP), and a 50% interest in 644,000 acres of petroleum and natural gas rights in the Horn River and Liard basins in BC, and be a partner in the project and acreage with Apache Corp., the companies said Monday.

Targa Buying Bakken Crude, NatGas Midstream Assets

Targa Resources Partners LP said Thursday it will acquire all of Saddle Butte Pipeline LLC’s ownership of its Williston Basin crude oil pipeline and terminal system as well as its natural gas gathering and processing operations for $950 million in cash.

Halcon Bulks Up in North Dakota

Halcon Resources Corp. on Monday said it is acquiring a shelf of oil-weighted producing and undeveloped properties in the Williston Basin in a cash-and-equity transaction with Petro-Hunt LLC worth $1.45 billion.

Industry Briefs

EnCap Flatrock Midstream LLC has closed its second private equity fund, EnCap Flatrock Midstream Fund II LP (EFM II), with commitments of $1.75 billion. The fund exceeded its $1.25 billion target and was significantly oversubscribed, EnCap Flatrock Midstream said. It received strong support from existing and new investors, it said. EnCap Flatrock Midstream now has nearly $3 billion in investment commitments from institutional investors and has made commitments to 10 portfolio companies across Funds I and II. Fund II recently announced a commitment to Caiman Energy II LLC as part of a $285 million total commitment from the firm. Caiman II will develop midstream infrastructure in the rich gas region of Ohio’s Utica Shale, including gathering pipelines and natural gas treating, processing and fractionation facilities. EFM II will be announcing a second commitment soon, EnCap Flatrock Midstream said.

$1.75B Raised for Resource Play-Focused Midstream Fund

EnCap Flatrock Midstream LLC has closed its second private equity fund, EnCap Flatrock Midstream Fund II LP (EFM II), with commitments of $1.75 billion.

Riverstone, Meritage Pursue More North American Midstream Ventures

Meritage Midstream Services LLC and private equity power broker Riverstone Holdings LLC on Wednesday said they were teaming up once again, with Riverstone providing $500 million to pursue new natural gas liquids (NGL) midstream opportunities in some of North America’s emerging resource plays.