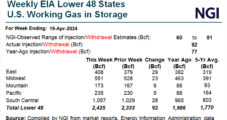

Supplies of natural gas in storage are stout everywhere, but East region inventories are closer to historical norms than any other section of the Lower 48. Should the densely populated Northeast sizzle amid scorching temperatures as forecast this summer, utilities in the heavy-gas consuming corner of the country could burn through more gas in the…

EQT Corp.

Articles from EQT Corp.

Weekly Natural Gas Cash Spot Prices Move Higher as Futures Stumble

Weekly natural gas cash prices gained ground on the back of strong gains in West Texas in a week that was marked by stronger LNG feed gas flows and modestly higher weather-driven demand. NGI’s Weekly Spot Gas National Avg. for the April 22-26 trading period climbed 9.5 cents to $1.230/MMBtu. Among the top weekly gainers,…

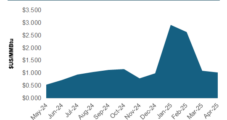

Natural Gas Forwards Mostly Lower as MVP Startup Impacts Summer Pricing

With excess storage inventories continuing to hang over the market through the shoulder season, natural gas forwards declined notably at the front of the curve for most regions during the April 18-24 trading period, data from NGI’s Forward Look show. May fixed prices at benchmark Henry Hub exited the period at $1.653/MMBtu, down 6.1 cents…

May Natural Gas Bidweek Prices Depressed on Second Day of Trade

As bidweek continued into a second day Thursday (April 25), baseload prices maintained the weak tenor established in Wednesday’s opener, according to NGI’s Bidweek Alert (BWA). Deal volumes were predominantly lower from Wednesday levels. Bidweek trading concludes on Friday. Leading on volume, Dawn in the Midwest saw 249,000 MMBtu/d in total volumes traded in 64…

Natural Gas Forwards Slide Overall as West Texas Outlook Brightens for Bulls

With excess storage inventories continuing to hang over the market through the shoulder season, natural gas forwards declined notably at the front of the curve for most regions during the April 18-24 trading period, data from NGI’s Forward Look show. May fixed prices at benchmark Henry Hub exited the period at $1.653/MMBtu, down 6.1 cents…

Natural Gas Futures Flop as Market Eyes LNG Weakness — MidDay Market Snapshot

Amid signs of ongoing issues at a major U.S. LNG export terminal, and with physical market prices pointing to weak near-term fundamentals, natural gas futures were headed for heavy losses as of midday trading Wednesday. Here’s the latest: May Nymex futures down 13.2 cents to $1.680/MMBtu as of 2:11 p.m. ET Day-ahead Henry Hub prices…

EQT Plans MVP Expansion to Serve Data Center Boom in Southeast

EQT Corp. said it would continue cutting 1 Bcf/d of production as U.S. natural gas prices remain near four-year lows, but management anticipates strong power generation demand in the coming years that has it planning an expansion of the Mountain Valley Pipeline (MVP). After a seven-year battle and a congressional mandate rescued the system from…

Texas LNG Plans to Start Construction This Year After EQT Tolling Deal Expanded

EQT Corp. has expanded an agreement to ultimately give it 2 million metric tons/year (mmty) of natural gas liquefaction capacity at Glenfarne Energy Transition LLC’s proposed export plant in Brownsville, TX. EQT, the largest U.S. natural gas producer, has signed another heads of agreement with Glenfarne for 1.5 mmty of tolling capacity at Texas LNG…

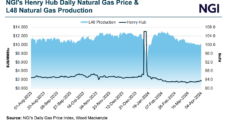

Natural Gas Prices Said Still Too Low for E&Ps to Bring On More Production

U.S. natural gas exploration and production (E&P) companies have reduced output in response to high inventories and the low price environment, but now the query is, when might production return? Price will tell, according to analysts. Lower 48 natural gas output has fallen below 100 Bcf/d, down from record highs around 107 Bcf/d early this…

EQT Eyeing Data Center ‘Gold Rush’ for Natural Gas-Fired Power, Unleashing More LNG

EQT Corp., the No. 1 natural gas producer in the United States, isn’t resting on its laurels. The gas giant is continuing to eye a potential East Coast LNG project, but it’s venturing into the artificial intelligence (AI) market, to gain a slice of the data center power market. Executive Vice President Rob Wingo, who…