Nearly all of the workers hired by the natural gas industry for jobs in the Marcellus and Utica shales in 2012 were residents of states in the region, according to a workforce survey conducted by the Marcellus Shale Coalition (MSC).

Tag / Employment

SubscribeEmployment

Articles from Employment

Oil/Gas Driving Colorado Economy, Researchers Find

Last year, Colorado’s oil and natural gas industry injected $29.6 billion into the state’s economy, supporting 110,000 mostly high-paying jobs, according to a study released Monday by a research unit at the Leeds Business School, University of Colorado (UC), Boulder.

Oil/Gas Driving Colorado Economy, Researchers Find

Last year, Colorado’s oil and natural gas industry injected $29.6 billion into the state’s economy, supporting 110,000 mostly high-paying jobs, according to a study released Monday by a research unit at the Leeds Business School, University of Colorado (UC), Boulder.

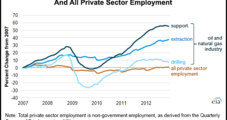

Oil and Gas Industry Employment Grew 40% Over Six Years

In the six years spanning 2007 through 2012, total U.S. private sector employment increased by more than one million jobs, or about 1%. However, over the same period, the oil and gas industry — segmented into drilling, extraction and support segments — increased by more than 162,000 jobs, which equates to a 40% increase,” according to a new study from the U.S. Labor Department’s Bureau of Labor Statistics (BLS).

House Testimony: Shales, Technology Made U.S. ‘Energy Rich’

The country is in the midst of an “unconventional revolution in oil and gas” whose implications reach well beyond the energy industry, IHS Vice Chairman Daniel Yergin, tells the U.S. House Subcommittee on Energy and Power in pre-filed testimony to be given Tuesday.

Industry Brief

CNOOC Ltd. has reportedly agreed to management and employment conditions set by the Canadian government as prerequisites to its proposed C$15.1 billion takeover bid for Calgary-based oil and gas producer Nexen Inc. Two sources familiar with the matter said CNOOC, an arm of state-controlled China National Offshore Oil Co., has agreed to reserve at least half of Nexen’s board and management positions for Canadians, along with other conditions recently requested by Alberta Premier Alison Redford, Bloomberg reported. Shareholders of Nexen voted 99% in favor of accepting CNOOC’s takeover offer (see Daily GPI, Sept. 21). But Canadian Prime Minister Stephen Harper has repeatedly cautioned North American money managers against assuming the bid is a done deal, and some polls indicate that a majority of Canadians oppose the deal. The final Canadian say is in the hands of the federal cabinet under the national Foreign Investment Review Act, which gives ministers wide discretion under a “benefits test” for big corporate deals.

People

The Railroad Commission of Texas (RRC) named Gil Bujano as director of the commission’s oil and gas division. Bujano has been serving as the acting director since March and is a 28-year veteran of the commission. He began his employment at the commission in 1984 at the San Antonio RRC district office and also has worked in the Abilene, Pampa and Houston district offices. After serving as assistant director in the Houston district office, Bujano transferred to Austin in June 2009 to supervise the commission’s technical permitting unit. In August 2010, Bujano was promoted to deputy director of the oil and gas division.

Bakken/Three Forks Oil Transport Capacity Grows

Rangeland Energy LLC’s COLT facility — North Dakota’s largest open-access crude oil marketing terminal, according to the company — has begun serving Bakken and Three Forks shale oil producers, the company said Monday.

People

Gene Isenberg, former CEO of Nabors Industries Ltd., has agreed to terminate his employment contract and waive a claim to $100 million that was triggered when the company promoted Anthony G. Petrello to CEO. Isenberg’s contract provided him with $100 million in cash and other bonuses under a severance-type payment. Nabors, which was criticized by shareholders when the contract terms were released, said Isenberg now is to receive no cash compensation and would forfeit about $7 million in deferred bonuses. Some of the proceeds are to be donated to charity. Isenberg’s estate is to receive a payment of $6.6 million, plus interest, when he dies. Isenberg, who had been CEO since 1987, retired in December but continues as chairman until June, when he is to become chairman emeritus.

Think Tank Challenges Marcellus Economic Impact

A Pennsylvania think tank believes a recent study inflates the economic importance of the Marcellus Shale.