Citing higher commodity prices, Tulsa-based independent Unit Corp. said it has ended a process for selling “up to all of its oil and gas properties and reserves.” The exploration and production (E&P) company has ended its engagement with Tudor, Pickering, Holt & Co. (TPH) to advise on the divestment process. CEO Philip B. Smith said…

Tag / Divestitures

SubscribeDivestitures

Articles from Divestitures

Brief — QEP Divestiture

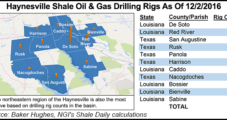

QEP Resources Inc. has agreed to sell some of its Uinta Basin assets to Middle Fork Energy Partners LLC for $155 million. The divestiture, subject to customary purchase price adjustments, includes 605 Bcfe of proved reserves and production of 54 MMcfe/d in 1Q2018, consisting of 23% liquids. The properties are located in Duchesne and Uintah counties in eastern Utah. QEP also operates in the Haynesville Shale, and the Williston and Permian basins.

Both Oil, Natural Gas Assets Still on Table as Chesapeake Continues Divestments

Chesapeake Energy Corp. won’t discriminate between its oil and natural gas properties this year as it looks to keep unloading assets in an ongoing quest to get leaner and cut another $2-3 billion of debt from its balance sheet.

Chesapeake Sells 78,000 Acres in Haynesville for $450M, Second Deal in Works

Chesapeake Energy Corp. has reached a deal to sell 78,000 acres in the Haynesville Shale in northern Louisiana to an unnamed private company, the Oklahoma City-based independent announced Monday.

Petrohawk Squeezed More Out of Shales Last Year

Petrohawk Energy Corp. charted 50% pro forma year-over-year reserves growth last year, ending 2010 with 3.4 Tcfe of estimated proved reserves, the company said. Shale plays led the charge, particularly with a 100% increase in production from the Haynesville and Bossier shales and a whopping 235% increase in the Eagle Ford in South Texas.

Rosetta Spending Targets Eagle Ford

Rosetta Resources Inc. will spend about 90% of its 2011 capital budget of $360 million on the liquids-rich window of the Eagle Ford Shale in South Texas, the Houston-based independent said. Spending will be funded from cash flow and planned asset sales in the Denver-Julesburg Basin and California.

Raymond James Raises ’04 Gas Forecast to $6/Mcf

After correcting the data for acquisitions and divestitures, U.S. natural gas production increased 1.6% sequentially, breaking a trend of lower production for the previous six consecutive quarters, according to Raymond James energy research. However, the bullish analysts were quick to point out several one-time events that contributed to the deceptively strong year-over-year production numbers.

El Paso Reaches 40% Mark in 2003 Divestiture Program

Checking off three more asset divestitures last week, El Paso Corp. announced it has completed or announced more than $1.35 billion in sales so far this year, approximately 40% of the company’s recently expanded asset sales goal of $3.4 billion for calendar year 2003.

El Paso Reaches 40% Mark in 2003 Divestiture Program

Checking off two more asset divestitures Monday, El Paso Corp. announced it has completed or announced $1.35 billion in sales so far this year, approximately 40% of the company’s recently expanded asset sales goal of $3.4 billion for calendar year 2003.

Burlington Posts 8% Hike in Earnings, 10% Increase in Gas Production

Burlington Resources Inc. reported an 8.2% increase in third quarter earnings to $79 million, or $0.39 per diluted share, including a net after-tax gain of $0.12 per diluted share from asset sales and accompanying tax benefits. Higher production, including a 10% increase in gas production to 1.8 Bcf/d, and lower cash operating costs, along with higher oil prices and the asset sale and tax benefits, more than offset lower prices for natural gas and higher interest expenses and production taxes. Realized natural gas prices fell to $2.65/Mcf (Henry Hub) from $2.89 in 3Q2001.