Rapid City, SD-based Black Hills Corp. closed a previously announced $243 million sale of approximately 85% of Bakken and Three Forks shale assets in the Williston Basin held by its Black Hills Exploration & Production Inc. (see Shale Daily, Aug. 27). The sale was effective July 1. CEO David Emery said the sale will allow the energy holding company to reduce its overall debt and fund growth projects. Black Hills also said it intends to redeem $225 million of senior unsecured 6.5% notes that were scheduled to mature May 15, 2013.

Closed

Articles from Closed

QEP Energy Adds Another Bakken Property from Unit Corp.

Tulsa, OK-based Unit Corp. said Friday its petroleum subsidiary has closed a previously announced sale of a little more than one-third of its interest in Bakken Shale properties to QEP Energy for $228 million. The deal was final as of July 1, 2012.

Mesa Energy Building Mississippian Limestone Position

Dallas-based Mesa Energy Holdings Inc. has leased 1,525 net acres in Garfield and Major counties, OK, and has closed on a farmout agreement with Twenty/Twenty Oil & Gas Inc. covering 1,720 net acres that are held by production.

Shale Liquids Bounty Is Light and Sweet

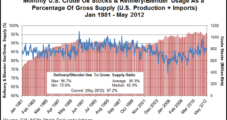

With heavy ramifications for Midcontinent energy infrastructure and eventual exports, the United States will find itself with oversupplies of both domestically produced liquids and crude oil from now through 2017, market consultant/analyst Rusty Braziel of RBN Energy LLC told a session of the Colorado Oil and Gas Association (COGA) annual meeting in Denver earlier this month (Aug. 13-16).

Industry Briefs

EnCap Flatrock Midstream LLC has closed its second private equity fund, EnCap Flatrock Midstream Fund II LP (EFM II), with commitments of $1.75 billion. The fund exceeded its $1.25 billion target and was significantly oversubscribed, EnCap Flatrock Midstream said. It received strong support from existing and new investors, it said. EnCap Flatrock Midstream now has nearly $3 billion in investment commitments from institutional investors and has made commitments to 10 portfolio companies across Funds I and II. Fund II recently announced a commitment to Caiman Energy II LLC as part of a $285 million total commitment from the firm. Caiman II will develop midstream infrastructure in the rich gas region of Ohio’s Utica Shale, including gathering pipelines and natural gas treating, processing and fractionation facilities. EFM II will be announcing a second commitment soon, EnCap Flatrock Midstream said.

$1.75B Raised for Resource Play-Focused Midstream Fund

EnCap Flatrock Midstream LLC has closed its second private equity fund, EnCap Flatrock Midstream Fund II LP (EFM II), with commitments of $1.75 billion.

Industry Briefs

Algonquin Power & Utilities Corp.’s (APUC) regulated distribution utility, Liberty Utilities, has closed its $285 million acquisition of Granite State Electric Co. and EnergyNorth Natural Gas Inc. Ontario-based APUC announced in December 2010 that it would buy the New Hampshire-based businesses from National Grid (see Daily GPI, Dec. 10, 2010) and the deal received final state regulatory approval in May. The gas utility serves 87,000 customers in five counties and 30 communities across the state. Its load and customer count have shown a consistent 1.6% compounded annual growth over the past 10 years, APUC said. The electric distribution company serves 43,000 customers. Last year Liberty said it would pay about $124 million for Atmos Energy Corp.’s regulated gas distribution assets in Missouri, Iowa and Illinois (see Daily GPI, May 16, 2011). That deal has received all necessary federal and state regulatory approvals and is expected to close by Aug. 1, APUC said.

Industry Briefs

Houston-based Vanguard Natural Resources LLC has closed on its acquisition of natural gas and liquids assets in the Arkoma Basin from Antero Resources for an adjusted price of $434.4 million, subject to post-closing adjustments. The effective date is April 1, 2012. The deal was announced early last month (see Shale Daily, June 5). Vanguard funded the acquisition with borrowings under its existing reserve-based credit facility. The borrowing base was increased from $670 million to $975 million in connection with an interim borrowing base redetermination to include the properties from the acquisition. Updated 2012 production and financial results guidance will be included with second quarter results, which are expected to be released on Aug. 2.

Chesapeake Completes Midstream Unit Sale

Chesapeake Energy Corp. on Monday closed on the first of its multi-asset transactions to sell its midstream businesses with the $2 billion sale of Chesapeake Midstream Partners LP (CHKM) to Global Infrastructure Partners (GIP) for $2 billion.

Industry Brief

Rapid City, SD-based Black Hills Corp. has closed the sale of energy marketing unit Enserco Energy Inc. to Houston-based Twin Eagle Resource Management LLC for $160-170 million. Twin Eagle obtained Enserco’s North American-based natural gas, power, coal and crude oil marketing operations. Enserco operations include crude gathering and marketing assets averaging 30,000 b/d through 12 owned or leased terminals; natural gas marketing with 8 Bcf of leased storage and 250,000 MMBtu/d of firm transportation; power marketing serving municipal and retail load; coal marketing and 35,000 tons per day of physical coal deliveries; as well as rail transportation contracts. The deal was announced by Black Hills in January (see Daily GPI, Jan. 20).