Joining the race to transition a fair amount of swaps and over the counter (OTC) business to a cleared futures model before more rules under the Dodd-Frank Wall Street Reform Act take hold in the coming months, CME Group on Monday launched a broad suite of new natural gas and power contracts that will be listed as futures on CME Globex, the New York Mercantile Exchange (Nymex) trading floor and CME ClearPort, and will be available for trading on CME Direct, a platform offering side-by-side trading and straight-through processing and clearing of exchange-listed and OTC energy markets.

Before

Articles from Before

U.S. LNG Exports Seen Gulf Coast-Focused

As happened in the rush to develop U.S. liquefied natural gas (LNG) import facilities a decade ago, relatively few of the proposed export projects now before federal authorities will be built, and most of them will be brownfield projects on the Gulf of Mexico (GOM), according to a top executive with one of the competing Gulf Coast-based projects.

Heightened North Dakota Drilling Spurs Data Sensitivity

It has been around for more than 30 years, long before the state’s current oil/gas boom, but North Dakota’s six months of confidentiality provided new wells is taking on greater interest in the midst of the competitive exploration and production (E&P) push throughout the industry.

TPC Takeover to Capitalize on Shale Growth, Says First Reserve

Gulf Coast petrochemicals maker TPC Group Inc. on Monday agreed to be taken private by First Reserve Corp. and SK Capital Partners in a cash-and-debt transaction valued at $850 million.

U.S. LNG Exports Limited, Gulf-Focused, Sempra Exec Says

As happened in the rush to develop U.S. liquefied natural gas (LNG) import facilities a decade ago, relatively few of the proposed LNG export projects now before federal authorities for permitting will get built, and most of them will be brownfield projects on the Gulf of Mexico (GOM), according to a top executive with one of the competing Gulf Coast-based projects.

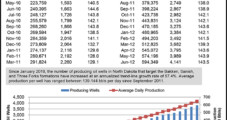

Marcellus, Eagle Ford Ready With More Gas, Barclays Finds

The Marcellus and Eagle Ford shales have exactly what the U.S. gas market doesn’t need right now: more gas on the way, according to natural gas analysts at Barclays Capital. They titled their latest note — an analysis of the effects of upcoming pipeline debottlenecking in the two plays — “Unleashing a Caged Monster.”

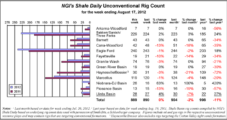

Soaring Niobrara-DJ Basin Rig Count Leads Unconventional Pack

The unconventional oil and gas rig count sagged in the week ending Aug. 17, with numbers flat or declining in 10 of the nation’s 13 unconventional plays compared with the week before, but the liquids-rich Niobrara-Denver Julesburg (DJ) Basin continues to soar, according to NGI’s Shale Daily Unconventional Rig Count.

Gastar’s Marcellus Output Surges

Gastar Exploration Ltd. said Wednesday net production from its Marcellus Shale assets have increased more than 34-fold in a year, a result of ramped up drilling activity in the liquids-rich portion of the play during the second quarter of 2012.

Smith Sees Light at the End of the Depressed Gas Price Tunnel

Stagnant natural gas production levels, which could fall into a decline before the year’s out, and an increase in gas demand for power generation and as a feedstock could spark a price rebound in 2013 as the supply-demand balance returns to equilibrium, according to Stephen Smith of Stephen Smith Energy Associates.

Industry Brief

The effort to put a natural gas severance tax hike before Arkansas voters has been suspended as backers came up short on the number of signatures necessary to put the issue on the November ballot (see Shale Daily, July 10; June 29). Tax hike proponent Sheffield Nelson told local news media he would make a final decision on whether to abandon the effort within a week. The campaign is short about 40,000 signatures after many were disqualifed. The campaign would need to make up the shortfall by Aug. 20 and deliver at least 62,507 valid signatures in total.