NGI Archives | NGI All News Access

Heightened North Dakota Drilling Spurs Data Sensitivity

It has been around for more than 30 years, long before the state’s current oil/gas boom, but North Dakota’s six months of confidentiality provided new wells is taking on greater interest in the midst of the competitive exploration and production (E&P) push throughout the industry.

It is not as important in the more fully drilled parts of the Bakken Shale formation, but for the newer Three Forks and Tyler areas in the greater Williston Basin, it is considered essential, according to a spokesperson for the Department of Mineral Resources (DMR).

“This essentially protects operators [for six months] from revealing their pool or formation that they are drilling into, and from what I understand pretty much every state has one of these confidentiality rules, but each is different,” said Alison Ritter, DMR spokesperson, emphasizing that this is not the same as the state’s hydraulic fracturing (fracking) chemical disclosure requirements (see Shale Daily, March 19).

“Our rules apply to all new wells — whether in a proven field or a wildcat,” said Ritter, adding that Wyoming recently changed its rules on confidentiality specifically applying to wildcat wells.

North Dakota’s rule applies to any new permit from the time it is issued through a six-month period. “It is just something that is on people’s radar of late,” she said.

Ritter said the most interest in the rule comes from mineral owners who are usually anxious to find out how much oil and gas a well is producing. “One of the things we can release when a well is under confidentiality status is the amounts of oil/gas sold on a month-to-month basis. Once it comes off confidentiality status anything produced or sold can be seen historically looking back.

“It was a surprise to me when people began calling about the rule lately. The rule was designed to protect wildcatters who, theoretically, are going out to find a new formation, but the rule doesn’t specify that it be a wildcat; it applies to any new permit.”

She conceded that there are many more operators now, and that may be driving increased interest in the confidentiality rule. “Maybe not necessarily for the Bakken, but for Three Forks and Tyler there is still new exploration taking place, and that [confidentiality rule] protects the operators when they go out to the Tyler to see what works.”

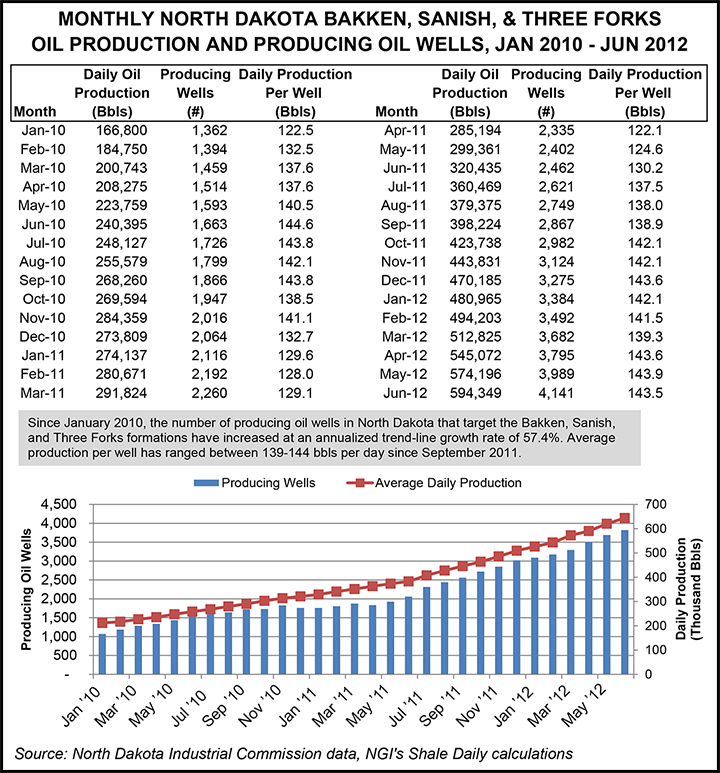

Since the beginning of 2010 the number of producing oil wells in North Dakota that target the Bakken, Sanish and Three Forks formations has increased at an annualized trend-line growth rate of 57.4%. Average production per well has ranged between 139-144 b/d since September 2011, according to NGI‘s Shale Daily calculations.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |