The three biggest pressure pumping providers serving U.S. operators — Halliburton Co., Schlumberger Ltd. and Baker Hughes Inc. — are facing a class action antitrust lawsuit over alleged price manipulation, which comes two weeks after the U.S. Department of Justice (DOJ) launched an investigation.

Baker

Articles from Baker

North American Drilling Market ‘Remains Uninspiring,’ Says Nabors CEO

Nabors Industries Inc., the largest onshore drilling fleet operator and the biggest supplier of pressure pumping equipment, is not optimistic about seeing gains in the U.S. oil or gas patch through the rest of this year, CEO Tony Petrello said Wednesday.

West Virginia Enviro Groups Ask USDA to Require Tracers

A coalition of nine environmental groups in West Virginia have asked the U.S. Department of Agriculture (USDA) to require that operators add tracers to fluids used in hydraulic fracturing (fracking) at Marcellus Shale oil and gas wells drilled near the Monongahela National Forest.

Industry Briefs

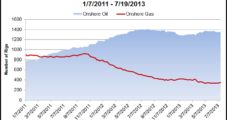

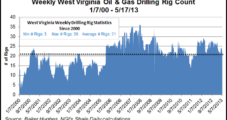

After five consecutive quarters of falling U.S. rig counts, onshore activity will improve through the rest of the year, according to a forecast by Baker Hughes Inc. There were 1,748 U.S. rigs in operation at the end of the first quarter, CFO Peter Ragauss said. “We anticipate that the rig count will rise to an average of 1,800 rigs for the second quarter. This would be the first increase in U.S. rig count following sequential declines over five consecutive quarters. And the rig count is expected to rise over the second half of the year.” Overall, “the increase from the first quarter is expected to be about 100 rigs, to a 4Q2013 average rate of approximately 1,850 rigs.” The average annual rig count this year “is projected to be 1,810 rigs, composed of approximately 1,400 oil rigs and 410 gas rigs.” The U.S. offshore rig count is forecast to be 8% higher, averaging 52 rigs with four more deepwater rigs than in 2012. The Canadian rig count in 2Q2013 is projected to decline sequentially by 70% to 160 average rigs because of the spring break-up.

Bleak Outlook Seen for Liquids Drilling Through 2013

The U.S. oil and natural gas rig count will fall through 2013, with a “glaring change” to the forecast for wet gas drilling, according to Raymond James & Associates Inc. A “meaningful rebound” won’t occur until the second half of 2014 and through 2015, analysts said Monday.

Arkansas Lawmaker Withdraws Severance Tax Bill

Arkansas state Rep. Tommy Lee Baker (D-Osceola) has withdrawn legislation (HB 1992) that would have ended severance tax exemptions for natural gas drillers due to a lack of support in the House Insurance and Commerce Committee.

Industry Brief

The Antitrust Division of the Department of Justice has approved Baker Hughes Inc.’s (BHI) plan to sell Superior Energy Services two stimulation vessels (the HR Hughes and the Blue Ray) and some other assets used to perform sand control services in the U.S. Gulf of Mexico (see Daily GPI, July 7). The asset sale, expected to close by the end of August, is being conducted in connection with BHI’s acquisition of BJ Services Co. (see Daily GPI, April 29). Once the Superior sale is closed BHI would be free to fully integrate BJ Services into its operations.

Service Companies See Shift to Onshore

Houston-based Baker Hughes Inc. (BHI) last said its quarterly earnings rose nearly 7% as North American markets, especially onshore, rebounded from a year ago. The company also is seeing a willingness “like never before” to invest in new technology, the COO said.

Baker Hughes Earnings Up on North America Gains

Houston-based Baker Hughes Inc. (BHI) on Tuesday said its quarterly earnings rose nearly 7% as North American markets, especially onshore, rebounded from a year ago. The company also is seeing a willingness “like never before” to invest in new technology, the COO said.

Industry Briefs

Baker Hughes Inc. (BHI) is selling a package of assets used in Gulf of Mexico offshore operations to a subsidiary of Superior Energy Services Inc. for $55 million. Once the transaction is completed, which is expected by the end of this month, BHI said it would be able to complete its merger with BJ Services’ U.S. operations (see Daily GPI, April 29). “While market conditions in the deepwater Gulf of Mexico are extremely uncertain now, the acquisition provides us with an established platform from which we plan to expand these new product and service offerings across Superior’s growing international footprint,” said CEO David Dunlap. The assets to be acquired include two stimulation vessels (the HR Hughes and Blue Ray) and BJ’s sand control completion tools product line, including a tool and screen manufacturing facility and technology center in Houston.