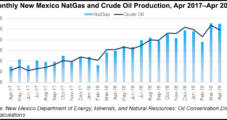

The Trump administration of late has had less to cheer about from quarterly Bureau of Land Management (BLM) oil and natural gas lease sales, but the Permian Basin continues to be a big draw in New Mexico.

Acres

Articles from Acres

NGI The Weekly Gas Market Report

Briefs — Cook Inlet Lease Sales

The Alaska Department of Natural Resources’ Division of Oil and Gas has issued a final written finding for the Cook Inlet Areawide Oil and Gas Lease Sales from 2019-2028, declaring that “the potential benefits of lease sales outweigh the possible negative effects,” and that the lease sales are in the best interests of the state. The proposed sale area totals 3.9 million acres that includes 2.2 million acres of uplands in the Matanuska and Susitna River valleys and 1.7 million acres of tide and submerged lands in upper Cook Inlet from Knik Arm south to Anchor Point and Tuxedni Bay. There are 815 tracts ranging in size from 640 to 5,760 acres. The state is the predominant landowner in the sale area.

BLM’s Utah Oil and Gas Lease Sale Nets $186,617

The U.S. Bureau of Land Management (BLM) in Utah reported Tuesday that it completed an oil and natural gas lease sale for 11 or 12 parcels offered, netting $186,617.

Brief — Continental STACK

Continental Resources Inc.is accepting bids through Friday (Dec. 11) for three packages of assets in Oklahoma’s Mississippian/Woodford Shale. The offer is for more than 80 wells in about 5,900 acres in the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties (STACK). The assets in Garfield and Kingfisher counties are being offered through EnergyNet.com. Garfield assets include 34 wells, with 21 producing. The six-month average production from the 34 wells is slightly more than 1 MMcf/d; The package also includes more than 1,900 leasehold acres. Another Garfield package includes about 3,000 net acres including 23 wells producing on average 530 Mcf/d and 26 b/d. In Kingfisher County, 26 wells are being sold across a 984-net-acre package, with average production of 1.06 MMcf/D and 160 b/d. Contact energynet.comor Denna Arias (281) 949-8463 for information.

Black Stone Entering East Texas Farmout, Buying Noble Assets for $340M

Black Stone Minerals LP, one of the largest owners of oil and natural gas mineral interests in the United States, has entered into a farmout agreement to develop assets in trending plays in East Texas, and plans to acquire a package of properties spread across 20 states from Noble Energy Inc. for $340 million.

Briefs — Carbon Appalachian

Carbon Natural Gas Co.affiliate Carbon Appalachian Co. LLC has paid an undisclosed seller $41.3 million for 780,000 net acres and 3,100 miles of natural gas pipelines and related facilities in West Virginia. The conventional assets are producing 37.4 MMcfe/d of natural gas and are 84% held-by-production. Carbon Appalachian was formed earlier this yearwith a $100 million equity commitment from two undisclosed investors to acquire and develop property in the region. It acquired another packageof assets in West Virginia over the summer. Carbon, which operates in the Appalachian, Illinois and Ventura basins, increased its ownership in the subsidiary to 19.37% from 16%.

PDC Spending, Swapping to Bolt-On Acreage in DJ Basin

PDC Energy Inc. has agreed to buy 8,300 net acres for $210 million and swap other land in two separate deals to block up its core Denver-Julesburg (DJ) Basin position in Weld County, CO.

Brief — Utah BLM Lease Sale

The U.S. Bureau of Land Management (BLM) Canyon Country District office in Utah is seeking public input for a proposed oil and natural gas lease sale in March for 45 parcels totaling 57,074 acres in areas covered by the Monticello and Moab field offices. Comments are being accepted through July 27 and would be used to prepare an environmental assessment. Details are available on the BLM website.

Brief — Texas Pacific Land Trust

Dallas-based Texas Pacific Land Trust (TPL) has formed a water unit to serve Permian Basin oil and natural gas operators. Texas Pacific Water Resources LLC plans to develop integrated water servicing agreements to include brackish water sourcing, produced water gathering/treatment/recycling, infrastructure development/construction, disposal, water tracking, analytical and well testing services. Operations are led by Robert A. Crain, who formerly led development of EOG Resources Inc.’s water resource programs in multiple divisions, including the Eagle Ford Shale and the Permian. TPL, created in 1888, is one of the largest landowners in Texas with about 888,333 acres in 18 counties. The trust has a perpetual oil and gas royalty interest in 459,200 acres. Revenue is derived from managing oil and gas royalties, grazing leases, easements, sundry/specialty leases and land sales.

Goodrich to Acquire, Swap Acres in Haynesville; Sees First Production From Long-Lateral Well

Goodrich Petroleum Corp. said it has agreed with an undisclosed party to acquire up to 2,200 net acres adjacent to its existing position in the Haynesville Shale in North Louisiana. It also announced completion results for a pair of operated, long-lateral wells targeting the play.