E&P | Eagle Ford Shale | Haynesville Shale | NGI All News Access

Goodrich to Acquire, Swap Acres in Haynesville; Sees First Production From Long-Lateral Well

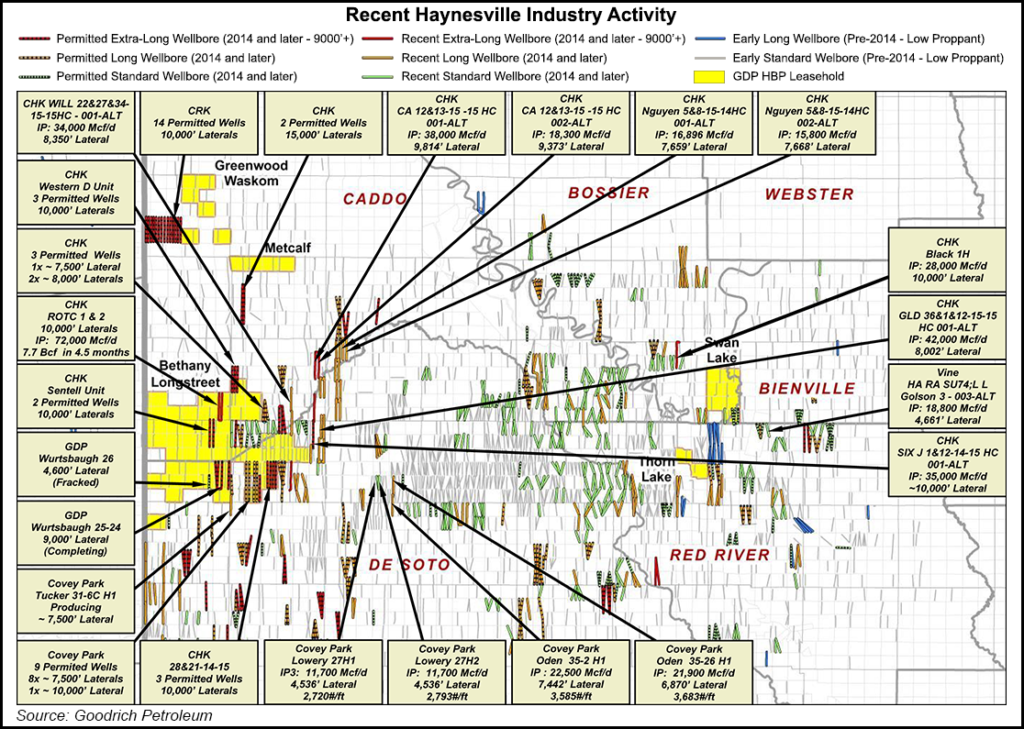

Goodrich Petroleum Corp. said it has agreed with an undisclosed party to acquire up to 2,200 net acres adjacent to its existing position in the Haynesville Shale in North Louisiana. It also announced completion results for a pair of operated, long-lateral wells targeting the play.

The Houston-based company said on Wednesday that it will earn the acreage by drilling and completing wells there, with no upfront cash consideration. Goodrich added that it has also entered into a swap on a portion of its undeveloped acreage in the Bethany-Longstreet Field with another operator.

According to Goodrich, the swap will add 22 Bcf to its proved reserves and expand its operated footprint in the area. The swap will also add to its inventory of extended lateral well locations and “provide for better planning and control over capital expenditures.”

The company said its Wurtsbaugh 26H-1 Alt well — which was drilled in DeSoto Parish, LA, with a 4,600-foot lateral and targets the Bethany-Longstreet Field — achieved a 24-hour peak production rate of about 22 MMcf/d. Meanwhile, Goodrich said it has finished hydraulic fracturing (fracking) activities at a second well with a 9,000-foot lateral, Wurtsbaugh 25&24H-1 Alt, and was expecting flowback to commence soon. The company holds a 74% working interest (WI) in the former well and a 69% WI in the latter.

During its 1Q2017 earnings conference call last month, Goodrich executives said the companyplans to drill another three long-lateral wells in the Haynesville during the second half of 2017. The wells are to be drilled with 10,000-foot laterals.

Goodrich is focused primarily on oil and natural gas targets in the Haynesville in North Louisiana and East Texas, the oil window in the Eagle Ford Shale in South Texas, and the Tuscaloosa Marine Shale (TMS) in eastern Louisiana and southwestern Mississippi. It holds 35,000 gross (16,000 net) acres in the core of the Haynesville; 13,000 gross (7,000 net) acres in the Angelina River Trend area of the Haynesville; 176,000 gross (128,000 net) acres in the TMS; and 32,000 gross (14,000 net) acres in the Eagle Ford.

With the aforementioned agreements, Goodrich said it will own the rights to about 25,000 net acres in the Haynesville.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |