NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

Storage Catch-Up Will Give NatGas Prices a Boost This Summer, NGSA Says

Production of natural gas will set records this summer, but so much of it will be needed to bring storage to adequate levels before the 2014-2015 winter heating season that the net result will be soft upward pressure on prices compared with last summer, according to the Natural Gas Supply Association (NGSA).

“When NGSA weighed all the different factors, the picture that emerged for this summer is one of slightly increased pressure on natural gas prices, chiefly because of the need to inject a greater than average amount of natural gas into storage in the wake of an extreme winter,” said NGSA Chairman Greg Vesey. Henry Hub prices averaged $3.77/MMBtu last summer.

NGSA made no specific forecast for summer natural gas prices.

NGSA based its 2014 Summer Outlook for Natural Gas on published data and independent analyses, evaluating the combined impact of the weather, economy, customer demand, production activity and storage inventories. NGSA emphasized that the upward pressure on prices it expects would be summer over summer and does not include data on winter prices.

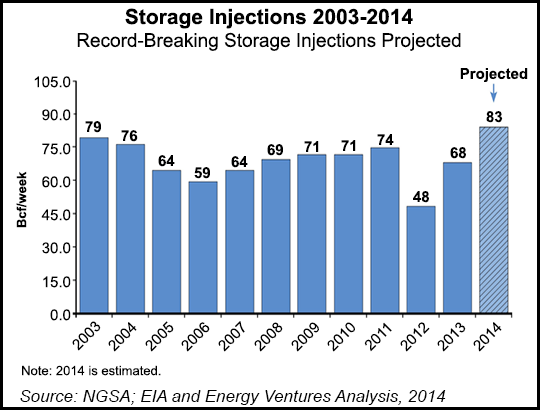

NGSA expects record-setting summer production of 68.5 Bcf/d, which would exert downward pressure on prices, to be more than offset by record weekly storage injections averaging about 83 Bcf/week (compared with 68 Bcf/week last summer). At that rate, storage levels would reach 3,400 Bcf by the end of the injection season.

“We have confidence in the market’s resilience and ability to achieve those record weekly injections, thanks to the industry’s responsiveness and the abundance of shale gas. It’s a testament to the flexibility of our industry that we were able to average storage injections of 79 Bcf/week even back in 2003 [see Daily GPI,May 9, 2003], long before shale gas had increased production to our current record-setting levels,” Vesey said.

Demand, on the other hand, isn’t expected to exert much force on natural gas prices either way. “The expectation for improved demand from industrial sector of 5% is offset by a projection for 3% electric sector decline due to less coal-to-gas switching by price-sensitive generators,” NGSA said. “Residential/commercial demand is predicted the same as summer 2013.”

The Energy Information Administration last week reported natural gas inventories at 1,380 Bcf, 748 Bcf less than last year and 922 Bcf below the five-year average (see Daily GPI, May 29).

NGSA’s analysis assumed temperatures nationally will average 1% warmer than last summer, placing neutral pressure on gas prices. Forecasters have said they expect a relatively mild summer this year, which would bring with it weaker cooling demand than in recent years (see Daily GPI, May 16).

A Federal Energy Regulatory Commission (FERC) report released last month indicated that rising natural gas prices this summer could provide the incentive to increase production 3% this year and help fill empty storage space (see Daily GPI, May 15). “Moderate natural gas burn and higher production would help natural gas storage recover from the current low levels,” FERC said. “However, summer natural gas-fired generation increasingly competes with storage injections for supply, and utilities may face some natural gas delivery constraints as LDCs [local distribution companies] and pipelines begin to refill storage.”

And NGSA said the nation’s economy will place neutral pressure on gas prices this summer.

“Improved unemployment numbers, the highest Consumer Sentiment Index numbers since 2007 and summer 2014 GDP [gross domestic product] growth expected to exceed last summer’s are encouraging, but the incremental improvement is not quite large enough to influence prices,” NGSA said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |