Infrastructure | LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

Rio Grande LNG Developer NextDecade Secures $50M From Abu Dhabi Investor

Abu Dhabi-based sovereign investor Mubadala Investment Co. has agreed to purchase $50 million in common stock in Houston-based liquefied natural gas (LNG) developer NextDecade Corp., the companies announced Thursday.

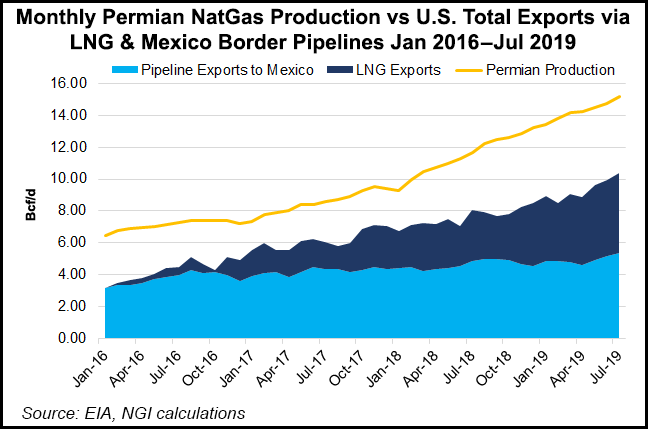

Issued to Mubadala at $6.27/share, the stock purchase will strengthen NextDecade’s capital position as it works to launch its Rio Grande LNG project near the South Texas border in Brownsville, management said. Developed alongside the the 4.5 Bcf/d Rio Bravo Pipeline, Rio Grande LNG would export 27 million metric tons/year (mmty), with NextDecade touting the project as a major link between Permian Basin associated gas and the global LNG market.

As part of its investment, Mubadala will get a seat on NextDecade’s board and will have the right to “contribute a certain amount of project-level capital” once a final investment decision (FID) has been made for Rio Grande LNG.

“Mubadala brings a valuable perspective on large-scale infrastructure investment and the growing role of LNG in the Middle East and other markets around the world,” NextDecade CEO Matt Schatzman said. “We look forward to a strong and lasting partnership.”

Khalifa Al Romaithi, Mubadala’s executive director of midstream operations, said, “We strongly believe that the Rio Grande LNG project is optimally positioned to provide a highly competitive export route for the abundant gas resources of the Permian Basin and a compelling commercial proposition for LNG customers, Permian producers and NextDecade shareholders alike.

“Our investment also reflects Mubadala’s positive outlook on the global gas market and the growing role of gas in the energy transition.”

NextDecade announced its first long-term supply deal for Rio Grande earlier this year, a 2 mmty commitment from a Royal Dutch Shell plc subsidiary.

Rio Grande, part of a so-called second wave of U.S. LNG export projects, is slated for FID in 1Q2020, with commercial operations to start in 2023.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |