NGI Archives | NGI All News Access

Revised Weather Outlook Lifts Both Physical and Futures

Physical natural gas prices for Wednesday delivery bounded higher by 12 cents overall on average Tuesday. A change in the near-term weather outlook was enough to shoot the screen higher, and cash quotes quickly followed.

Both East and West Coast market points posted double-digit gains, with California locations supported by strong power demand and resulting stout next-day pricing. At the close of futures trading October had increased 8.5 cents to $3.666 and November had added 7.6 cents to $3.760. October crude oil added 89 cents to $108.54/bbl.

Weather forecasts turned warmer over the extended weekend. Commodity Weather Group in its morning six- to 10-day outlook showed a pattern of above-normal temperatures extending from Vermont and Virginia to the West Coast with hot events in Texas as well. Matt Rogers, president of the firm, said, “[W]e are still seeing national demand increases on the forecast changes over the holiday weekend with more bursts of warmth into the Midwest and East over the two-week forecast window. We also see hot weather in the West frequently.

“The South still leans hot at times, especially toward Texas this week, with mid-to-upper 90s. Warm-leaning patterns in the first half of September contribute much less [energy] demand to the national equation than what we can typically see with the same situation in August.”

Gas for next-day delivery at eastern points jumped, and near-term weather forecasts showed above-normal temperatures in New England, but normal temperatures elsewhere. Wunderground.com forecast that Tuesday’s high in Boston of 86 was expected to drop to 82 Wednesday and slump further to 73 by Thursday. The normal early September high in Boston is 76. New York City’s Tuesday high of 82 was anticipated to ease to 79 Wednesday and Thursday. The seasonal high in New York is 80. In Philadelphia Tuesday’s 83 degree high was predicted to slide to 81 Wednesday and 79 Thursday. The normal high in Philadelphia this time of year is 79.

Next-day power prices in the East were mixed. IntecontinentalExchange reported that next-day peak power at the New England Power Pool’s Massachusetts Hub rose $5.60 to $45.50/MWh and at PJM West next-day peak power packages were seen at $40.11, down $3.03.

A mixed near-term temperature forecast and mixed power pricing environment may have kept New England Wednesday gas on either side of unchanged, but eastern deliveries scored double-digit gains. At the Algonquin Citygates gas for Wednesday delivery slipped about 6 cents to $3.88, and gas at Iroquois Waddington added 8 cents to $4.22. On Tennessee Zone 6 200 L Wednesday packages changed hands at $3.80, down 3 cents.

More southerly pipes experienced solid gains. Gas on Dominion rose by 14 cents to $3.41, and deliveries to Tetco M-3 added 17 cents to $3.64. Gas bound for New York City on Transco Zone 6 gained 13 cents to $3.79.

The maintenance and infrastructure-challenged Marcellus managed some hefty gains. Tennessee Zone 4 Marcellus added 46 cents to $1.62, and deliveries to Transco-Leidy rose by 51 cents to $1.68.

California prices surged as well as high power loads and resulting strong next-day power prices provided a firm footing for higher next-day gas. The California Independent System Operator forecast that Tuesday’s peak power load would reach a stout 42,951 MW and Wednesday’s peak load would rise further to 43,337 MW.

IntercontinentalExchange disclosed that next-day peak power prices at SP-15 jumped $11.34 to $63.41/MWh and power at Mid-C added $7.05 to $55.82/MWh. Power at Palo Verde added $4.81 to $44.41/MWh.

At the PG&E Citygates gas for Wednesday delivery rose by 11 cents to $4.11, and gas at the SoCal Citygates gained 15 cents to $4.02. Packages at the SoCal Border surged 14 cents to $3.93, and parcels on El Paso S Mainline were seen 13 cents higher at $3.96.

With October futures now well above $3.58 resistance, that is now “the new support level [and] the next main area of technical resistance is around the $3.80 level. The main driver pushing price into the new higher trading range has been yet another change in the upcoming weather patterns as well as a pickup in activity in the tropics,” an analyst at the New York-based Energy Management Institute said.

The Atlantic Basin, however, is mostly quiet. “Today is the 95th day of the Atlantic hurricane season with still zero hurricanes so far. The models are showing a few windows with tropical development potential, but the earliest risk to the Gulf looks to be toward late next week into the middle part of September,” Rogers said.

In its 2 p.m. EDT report the National Hurricane Center said there were no tropical cyclones in the Atlantic; however, it was watching three systems: one in the eastern Bay of Campeche, one in the eastern Caribbean, and another southeast of the Cape Verde Islands. None of the systems were given more than a 30% chance of developing into a tropical cyclone in the succeeding 48 hours.

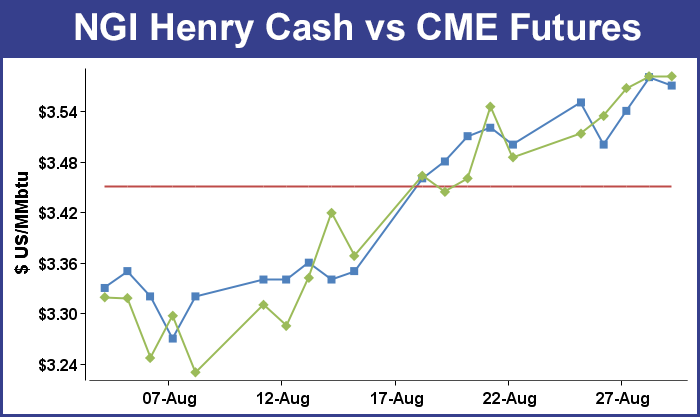

With Tuesday’s advance, prices are now in a new technical regime. “Prices have now advanced in five days out the past six, to levels not seen since the end of July as the return of hot weather to the central part of the U.S. helped the market catapult well above the key $3.50 resistance level as the Nymex October gas contract begins it spot month tenure,” said Addison Armstrong of Tradition Energy in a note to clients.

Mike DeVooght, president of Colorado-based DEVO Capital, sees the market “supported, in the front month, by hot temps but industrial demand does seem to be slipping.” He advises trading accounts to hold on to a short October position rolled from what was initially a short June at $4.35, and to risk 25 cents on the trade. End-users should stand aside, and those with exposure to lower prices should hold the remainder of a short September-October strip from $3.75 to $3.95 and also hold a short November-March strip initiated earlier at $4.50 to $4.60.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |