NGI Archives | NGI All News Access

Poll: Ohioans Back Severance Taxes, Especially if Income Taxes Cut

A poll shows a majority of Ohio voters support new severance taxes on hydraulic fracturing (fracking) and natural gas liquids (NGL), especially if the revenue raised is used to cut state income taxes, an idea proposed by Gov. John Kasich.

According to a Quinnipiac University poll, 62% of respondents said they would support the proposed taxes if the revenue went to cut state income taxes, while 31% were opposed. That represents a 2% increase in support from another Quinnipiac poll on May 9, when voters backed it 60-32% (see Shale Daily, May 14).

The proposed taxes garnered more support among independents (66-27%) and Democrats (65-28%) than Republicans (52-40%). Support for the idea was also strong among blacks (68-27%) and whites (62-31%), as well as women (63-30%) and men (62-32%).

But the poll, which was released Dec. 12, also found that support for the proposed taxes falls dramatically — to 52-38% in favor, a 10% decrease — without the stipulation that generated revenue be applied to reducing state income taxes for residents. In the May 9 poll, 55% of respondents favored the proposed taxes without the stipulation while 35% were opposed.

Democrats and independents still favored the taxes (by 63-28% and 56-33% margins, respectively) without the stipulation, but Republicans were opposed, 56-33%. Support was also more tepid among men (52-39%), women (51-37%0, whites (52-38%) and blacks (49-36%).

Republican leaders in the Ohio General Assembly have indicated that they will consider Kasich’s proposed severance taxes in 2013 (see Shale Daily, Dec. 24).

Last March, Kasich had proposed new taxes on fracking and NGL production, with the revenue passed along to Ohioans in the form of a personal income tax cut (see Shale Daily, March 6). But the Republican-controlled House was unenthusiastic about raising taxes and tabled the proposal (see Shale Daily, March 20).

Kasich’s plan would have taxed unconventional wells producing oil and NGLs at a rate of 1.5% of gross receipts for the first year. Producers that didn’t recoup their investment in the first year could apply to extend the 1.5% rate for a second year, but otherwise they would pay a standard rate of 4% of gross receipts annually for the remainder of the life of the well (see Shale Daily, March 15).

The governor’s plan also called for taxing unconventional gas wells at 1% of gross receipts; eliminating the severance tax on conventional gas wells that produce less than 10 Mcf/d; taxing conventional wells that produce more than 10 Mcf/d by 1% on gross receipts up to a cap of 3 cents/Mcf; and implementing a $25,000/well fee to benefit local governments. Taxes for conventional wells producing oil and NGLs would have remained unchanged.

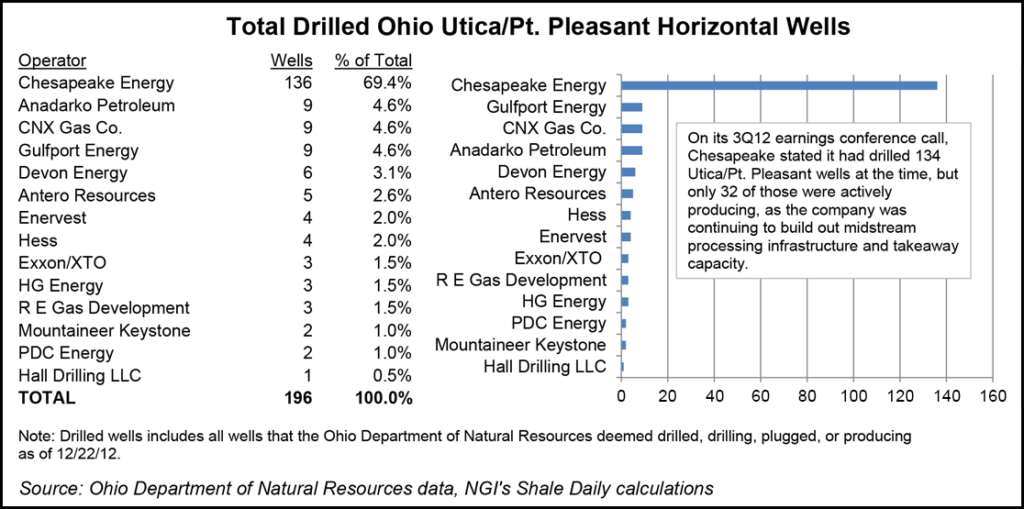

There were a total of 196 drilled horizontal wells in Ohio’s Utica/Pt. Pleasant as of Dec. 22, the vast majority of them, 136, operated by Chesapeake Energy, according to Ohio Department of Natural Resources data. During the company’s 3Q2012 earnings conference call, Chesapeake management said only 32 of its Utica/Pt. Pleasant wells were actively producing as the company was continuing to build out midstream processing infrastructure and takeaway capacity.

Quinnipiac surveyed 1,165 registered voters from Dec. 4 through 9. The poll has a margin of error of plus/minus 2.9%.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |