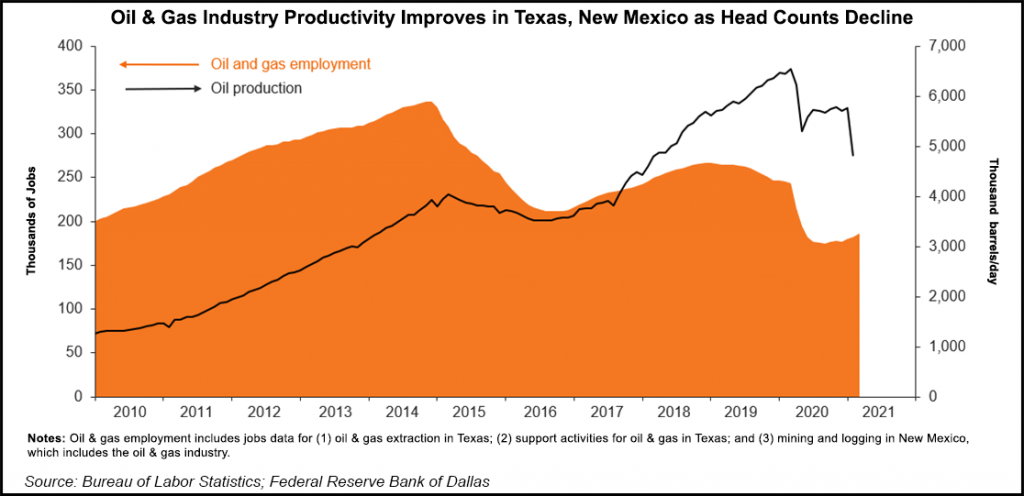

The technological breakthroughs that sparked the Lower 48 oil and natural gas revolution jolted economic activity across the Permian Basin, but the efficiencies reduced the need for people, creating a conundrum of sorts, according to the Federal Reserve Bank of Dallas.

Business economist Garrett Golding and research analyst Sean Howard of the Dallas Fed, as it is known, recently illustrated how productivity has improved in the Permian across West Texas and New Mexico. The Eleventh District monitors economic activity across the energy heartland that includes Texas parts of New Mexico

However, fewer people are needed to keep the wells drilled and rigs running, even as production has increased.

“The region’s oil and gas firms employ fewer people today than at the beginning...