Permian Oil Drilling Permits Climb, while Lower 48 Natural Gas Stronger

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |

Markets

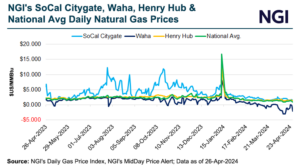

Natural gas futures fell Friday, with the May contract touching lows below $1.500/MMBtu before bouncing back on its last day as the front month. The June contract also fell, under pressure from milder weather patterns taking over and delaying expectations for summer’s heat to arrive. At A Glance: May Nymex rolls off board LNG exports…

April 26, 2024By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.