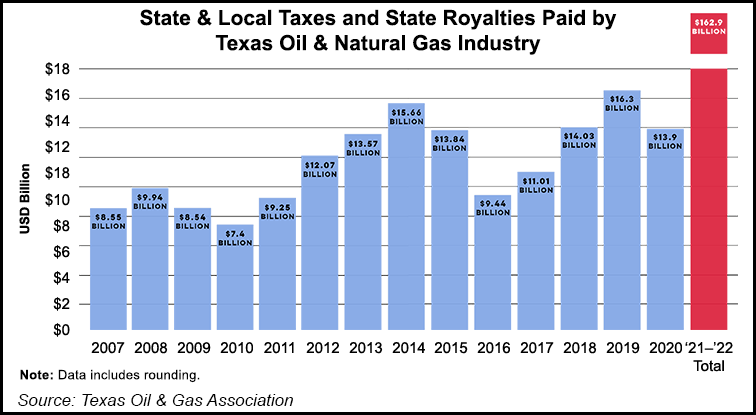

Lifted by revenue pulled from the Permian Basin in West Texas, the state’s oil and natural gas industry paid $13.9 billion in taxes and royalties in fiscal 2020, or around $38 million/day, according to a top industry group.

Data compiled by the Texas Oil & Gas Association (TXOGA) indicated state energy industry taxes and royalties provided direct support to Texas independent school districts (ISD), as well as teachers, roads, infrastructure and essential services.

“Even in an extremely difficult year, the Texas oil and natural gas industry continues to contribute tremendously to state and local tax coffers, while fortifying our energy security and leading the way in innovation and investment that is advancing environmental progress,” said President Todd Staples. “The...