NGI Archives | NGI All News Access

Oilier Plays Remain Foundation of Rig Count Increases

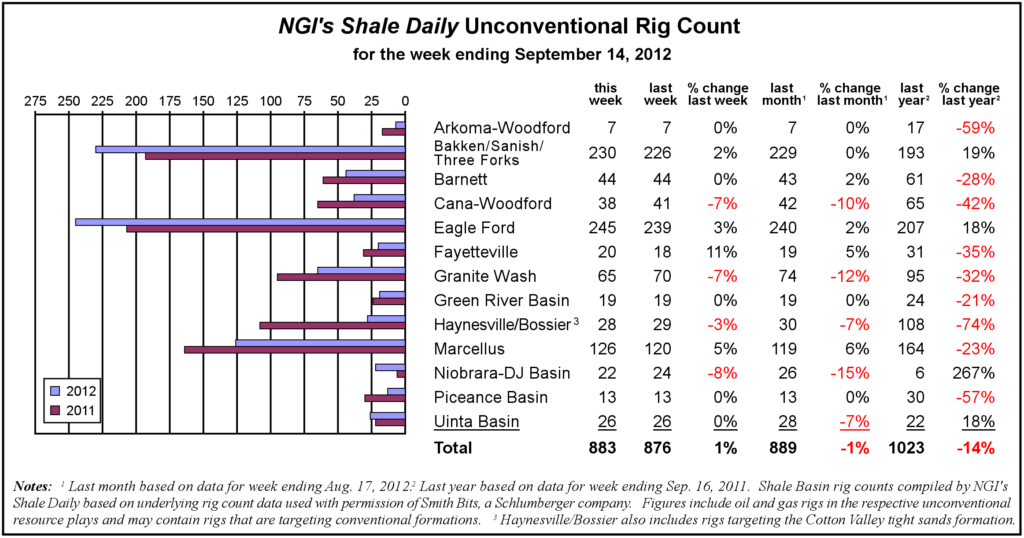

The number of operating unconventional rigs increased by seven (1%) in the week ending Sept. 14 but was down significantly (140 rigs, or 14%) compared to last year, according to NGI‘s Shale Daily Unconventional Rig Count.

The total rig count was 883, up from 876 a week earlier. Rig counts increased or held steady in nine of the nation’s 13 unconventional plays compared with both the week and the month before. Four plays — the Cana-Woodford, Granite Wash, Haynesville/Bossier and Niobrara-DJ Basin — saw rig counts decline over the past week and past month.

But only the Bakken/Sanish/Three Forks, Eagle Ford and Niobrara-DJ Basin showed an increase in drilling activity over a year ago, and much of that growth appears to be based on drillers’ interest in the oilier parts of those plays.

The Bakken/Sanish/Three Forks play, which has been one of the hottest unconventional oil and gas targets for producers over the last year, recorded another increase in rigs, though its pace slowed a bit. There were 230 rigs active in the play, up 2% from 226 the week before and one more than last month. There were 193 rigs in the Bakken/Sanish/Three Forks last year.

North Dakota continued its torrid pace of month-over-month production increases in oil and natural gas, driven principally by the Bakken Shale, according to statistics released Wednesday by the state’s Department of Mineral Resources’ Industrial Commission (see Shale Daily, Sept. 14). According to preliminary numbers, July crude oil production in the state was 20.896 million bbl, compared with 19.938 million bbl in June. The state produced an estimated 22.282 Bcf of gas in July, up from 20.998 Bcf in June. But even with a multi-billion-dollar natural gas gathering and processing infrastructure buildout ongoing, the state isn’t likely to greatly reduce the volumes of gas being flared as an offshoot of its accelerated oil boom, according to a recent analysis by RBN Energy LLC (see Shale Daily, Sept. 10).

The Eagle Ford, which had 245 rigs in NGI‘s count, up 3% from a week before and 18% from last year, recently got another 300 MMcf/d of processing capacity when Enterprise Products Partners LP started operation of the second train at its Yoakum cryogenic gas processing plant in Lavaca County, TX (see Shale Daily, Sept. 11).

The oil-rich Niobrara-DJ Basin has seen a 267% increase in rigs over the last year. Helping to drive the Niobrara-DJ Basin numbers higher was recent activity by Noble Energy Corp., which has gone from three to seven horizontal rigs in the play in the past 15 months and plans to have 10 running by the end of the year (see Shale Daily, Aug. 14).

Domestic natural gas production will be at an all-time high this year and is expected to break that record for a third consecutive year in 2013, thanks in large part to the nation’s booming shale plays, according to the U.S. Energy Information Administration (EIA) (see Shale Daily, Sept. 12). Total marketed production, which was 66.22 Bcf/d in 2011, will reach 68.86 Bcf/d this year, EIA said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |