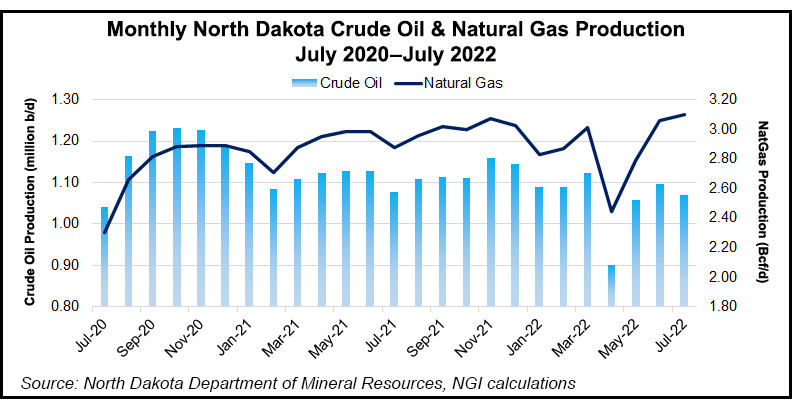

North Dakota posted a 1.5% month/month increase in natural gas production and a record high volume of gas captured in July, despite a 2.5% decline in oil output.

Natural gas production averaged 3.1 Bcf/d, of which 3 Bcf/d or 94% was captured and sent to market while the remaining 6% was flared off, according to the latest statistics from the Department of Mineral Resources (DMR). This compares to production of 3.06 Bcf/d with 2.79 Bcf/d captured in June.

July marked the first time in history that operators in the state have captured and put to market more than 3 Bcf/d.

“We didn’t have record production but the great news is we had record gas capture,” said DMR’s Lynn Helms, oil and gas division director, on Thursday.

Oil production fell to 1.07 million b/d in...