Markets | Natural Gas Prices | NGI All News Access | NGI The Weekly Gas Market Report | Shale Daily

North American Natural Gas Futures Inching Up; Cenagas Announces 2024 Changes – Mexico Spotlight

North American natural gas prices showed a little bit of momentum this week, but remained well under the $3 mark.

The New York Mercantile Exchange contract for February natural gas ended its first day as the prompt month on Thursday at $2.557/MMBtu. January futures rolled off the board Wednesday 6.9 cents higher day/day at $2.619.

U.S. production continues to be very strong at around 105 Bcf/d, offsetting strong liquefied natural gas pulls of about 15 Bcf/d.

Querétaro-based marketer Gas Primo’s Ignacio Martinez told NGI’s Mexico GPI that “everything indicates that the United States has a lot of supply,” with no great expectations among Mexico clients of a price spike.

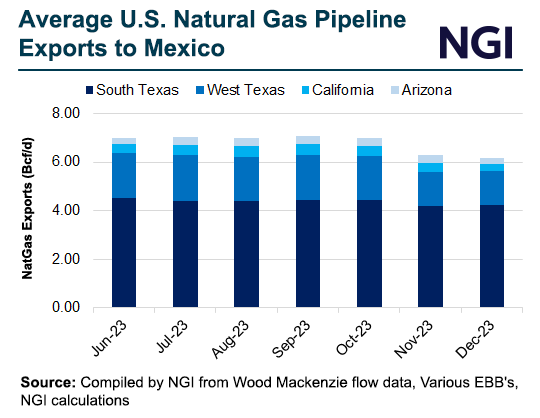

Imports of the fuel in Mexico have sagged over the holiday period. For the past 10 days through Thursday, Mexican imports of natural gas were 5.82 Bcf/d, according to NGI calculations. This is a decrease of 0.23 Bcf/d from the previous 10-day period, with imports bottoming to a low of 5.22 Bcf on Christmas Eve.

“December 2023 is on track to have a lower overall demand average than November 2023, quite the opposite from previous predictions,” said NGI analyst Josiah Clinedinst. November saw Mexico import 6.27 Bcf/d of natural gas from the United States via pipeline and December is currently at 6.17 Bcf/d.

South Texas cross-border flows remained just above 4 Bcf/d, averaging 4.02 Bcf/d over the past 10 days. “Reduced demand from across the West Texas, California and Arizona sectors continues to persist,” Clinedinst said.

Cenagas Changes

Cenagas, the operator of Mexico’s national pipeline system Sistrangas, announced changes that would impact users.

Cenagas has lowered the “porcentaje de gas natural combustible” from 1.263% to 1.159% for 2024.

Gas natural combustible is the equivalent of fuel or shrink in the United States. It is a cost generally borne by shippers, according to NGI’s director of strategy and research Patrick Rau.

Cenagas also announced changes to tariffs across its system. Details, in Spanish, can be found here.

“They’ve raised rates in some areas, but marketers will also benefit from the fuel charge, and this along with lower prices will benefit users,” Navarrés Gas Natural’s Norberto Catalan told NGI’s Mexico GPI.

Meanwhile, Cenagas has yet to announce winners on the open season that would make available 584,801.71 GJ, or 564.04 MMcf/d, of uninterruptible capacity. The state-run pipeline operator has said it expects transport service for successful bidders to begin by March 1.

New Gas Deals

Mexican conglomerate Grupo Carso SAB signed a deal with state utility Comisión Federal de Electricidad (CFE) to build and operate a natural gas pipeline that would run across the states of Sonora and Baja California for a distance of about 416 kilometers, or around 260 miles.

CFE would source the gas from the United States, using its capacity on both sides of the border.

Carso’s pipeline would supply natural gas to existing power plants in both Mexican states, as well as to the 641 MW González Ortega combined cycle plant planned for Mexicali, Baja California and the 648 MW San Luis Río Colorado combined cycle plant planned for Sonora.

Steelmaker ArcelorMittal also said it had renewed a natural gas contract with CFE’s international marketing arm, CFEnergía, worth $2.7 billion over 10 years.

Mexico Prices

In Mexico on Wednesday, natural gas cash prices at Los Ramones jumped 26.7 cents day/day to $2.680, according to NGI data. Monterrey via the Mier-Monterrey system was up 26.3 cents to $2.447. Tuxpan in Veracruz via Cenagas saw the spot price rise 26.8 cents to $3.312.

Out West, the Guadalajara natural gas price rose 51.1 cents to $3.445 on Wednesday. Farther north in El Encino, prices via Tarahumara were $2.852, 75.1 cents higher than the previous day. On the Yucatán Peninsula, the cash price at Mérida was $4.154 on Wednesday, up 27.1 cents.

U.S. Storage

On Thursday, the U.S. Energy Information Administration (EIA) reported an 87 Bcf withdrawal from storage for the week ending Dec. 22. The result barely moved the needle.

The South Central region, close to Mexico pipelines, saw a 16 Bcf withdrawal. That included a 14 Bcf pull from nonsalt facilities and 2 Bcf from salts.

For the week ended Dec. 22, total working gas in the U.S. South Central region stood at 1,187 Bcf, up from 1,084 Bcf for the same time one year ago. The figure was 42 Bcf higher than the five-year average of 1,145 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 | ISSN © 2158-8023 |