Natural Gas Prices | Bidweek | Daily GPI | NGI All News Access | NGI Weekly Gas Price Index | Shale Daily

NGI Gains FERC Re-Approval as Natural Gas Price Index Developer

Natural Gas Intelligence (NGI), a natural gas price reporting agency, has gained re-approval by the Federal Energy Regulatory Commission (FERC) as a price index developer meeting all or substantially all of the standards outlined in an April 2022 revised policy statement governing natural gas price indexes.

In its July 11 order in FERC Docket No. PL03-3-010, the Commission said “NGI’s Methodology Guide and Code of Conduct are substantially consistent with the Commission’s standards for price index developers.”

NGI, which publishes natural gas price indexes such as Henry Hub, Houston Ship Channel, Chicago Citygate and PG&E Citygate to name a few, filed its application for re-approval at FERC in January.

“NGI is committed to price transparency in the natural gas market, and this re-approval affirms our strict compliance to the standards the FERC has detailed,” said NGI CEO Dexter Steis.

Among the changes in the revised policy statement, FERC modified its standards so that each index developer is required to seek re-approval every seven years to demonstrate that it fully or substantially meets the standards set forth by the Commission’s initial Policy Statement on Natural Gas and Electric Indices in Docket No. PL03-3-000. These include minimum standards for: (1) code of conduct and confidentiality; (2) completeness; (3) data verification, error correction and monitoring; (4) verifiability; and (5) accessibility.

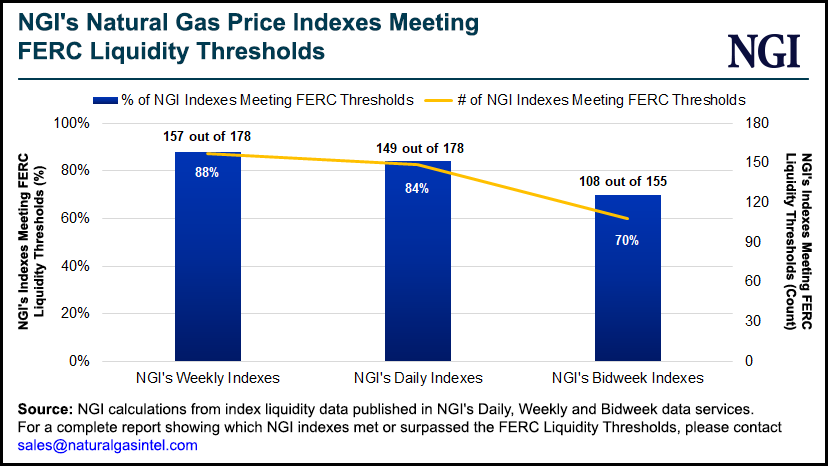

As part of its application, NGI also released an analysis of its price indexes that demonstrate they satisfy or exceed the FERC’s liquidity thresholds.

NGI’s analysis showed that 149 (84%) of NGI’s Daily Indexes, 157 (88%) of NGI’s Weekly Indexes and 108 (70%) of NGI’s Bidweek Indexes met or exceeded the liquidity thresholds detailed by FERC.

To request a copy of the full analysis, email NGI at info@naturalgasintel.com. If you’d like to see NGI price indexes in action or learn more, start here.

In the revised policy statement, FERC clarified the review period for assessing the liquidity of natural gas price indexes in Commission-jurisdictional tariffs to 180 continuous days of the most recent 365 days. The Commission indicated this would help to ensure that indexes referenced in its jurisdictional tariffs were sufficiently liquid.

Since 2008, NGI has enhanced the liquidity of its price indexes through a perpetual partnership with Intercontinental Exchange (ICE), by including ICE trade data in its proprietary price index determination process. The increased volume and number of deals in NGI’s indexes reflect data from the ICE trading platform for those companies not already directly reporting to NGI.

“NGI works with its many price reporters (data providers), as well as ICE, which provide NGI with the deep and high-quality data from which the daily, weekly and bidweek indexes are constructed,” Steis said.

“NGI is grateful to the Commission for its guidance and leadership in this area, which is crucial to this mature and well-functioning market.”

FERC revised the policy to encourage more market participants to report their transactions to price index developers. The policy is designed to provide greater transparency into the price formation process and increase confidence in the accuracy and reliability of wholesale natural gas prices.

NGI understands the importance of price transparency in the natural gas market. As such, it continually engages the market to stay on top of changes in patterns of price reporting through attentiveness to trading changes that impact individual price hubs and more generally in terms of overall reporting and market trends. For more than 40 years, this careful and ongoing analysis has allowed NGI to produce robust natural gas price indexes that are reflective of market value.

Founded in 1981, NGI believes that transparent markets empower businesses, economies and communities. Through its Subscription Services, NGI provides daily, weekly and bidweek natural gas price indexes for more than 160 locations throughout the United States, Mexico and Canada.

NGI also produces natural gas forward curves out 10 years, as well as Mexico, U.S. shale and indicative North American liquefied natural gas (LNG) netback pricing, which is part of its larger LNG Data Suite.

In addition to these key market price transparency data offerings, NGI provides a suite of news, analysis and information services that help businesses across the global energy value chain make day-to-day decisions.

| LETICIA GONZALES E-mail: leticia.gonzales@naturalgasintel.com Tel: (713) 502-7085 |

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1258 | ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1258 | ISSN © 2158-8023 |