Natural gas futures hovered close to unchanged early Thursday as traders awaited updated government inventory data that was expected to reveal a weekly withdrawal in line with historical norms.

The May Nymex contract was up 0.2 cents to $1.720/MMBtu as of 8:41 a.m. ET. June was trading at $1.957, up 0.4 cents.

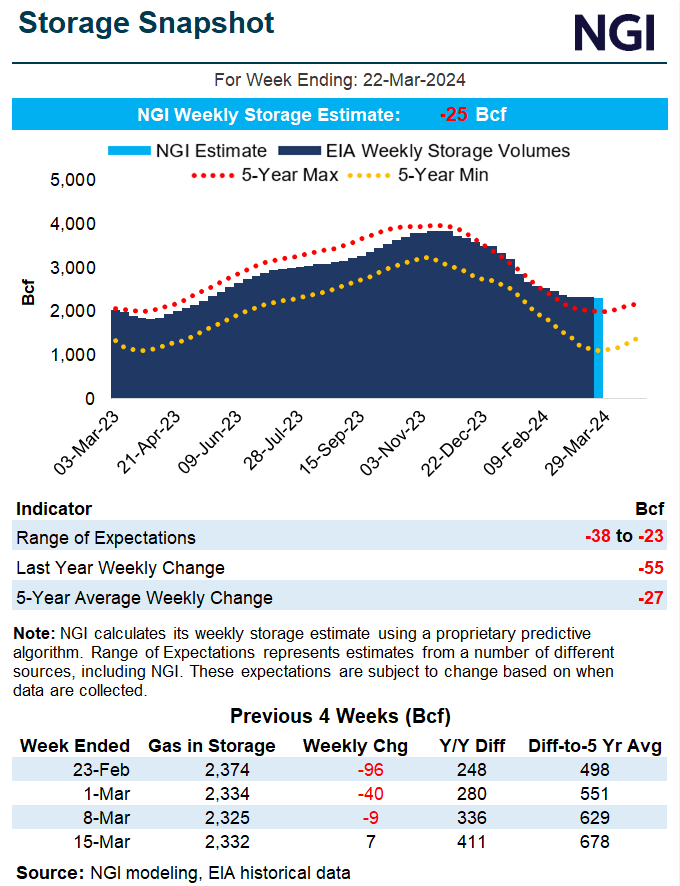

Predictions ahead of the U.S. Energy Information Administration’s (EIA) latest weekly natural gas storage report, scheduled for 10:30 a.m. ET, pointed to a modest springtime pull near the five-year average withdrawal rate.

Reuters survey responses ranged from withdrawals of 23 Bcf to 32 Bcf and produced a median 28 Bcf. Estimates submitted to Bloomberg ranged from withdrawals of 23 Bcf to 38 Bcf, with a median 27 Bcf pull.

NGI modeled a 25 Bcf withdrawal for the...