Supportive fundamental trends, including signs of recovering export levels, spurred natural gas futures to early gains as traders awaited the latest government inventory release Thursday. The October Nymex contract was up 8.9 cents to $2.769 at around 8:50 a.m. ET, erasing a 6.3-cent sell-off from the previous session.

An apparent uptick in volumes flowing to the Freeport LNG terminal, coming off a conspicuous drop in feed gas nominations there recently, was “spurring bullish spirits” early Thursday, according to EBW Analytics Group analyst Eli Rubin.

This comes as “gas production remains subdued…with the seven-day moving average falling to seven-week lows, offering further optimism,” Rubin said.

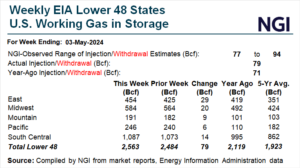

Traders early Thursday were also preparing to digest updated inventory...