Markets | LNG | Natural Gas Prices | NGI All News Access | Shale Daily

Natural Gas Futures Pull Back as Traders Await Latest EIA Print

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2158-8023 |

Earnings

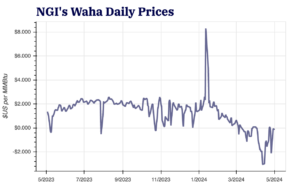

Pipeline constraints in the oil-rich Permian Basin have not impacted Diamondback Energy Inc.’s production, but “pushing out more pipes” could help low natural gas prices in West Texas. During a call to discuss first quarter results, CEO Travis Stice said, “we’re going to continue to need pipes being built about every 12-18 months in the…

May 2, 2024NGI All News Access

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.