Marcellus | NGI All News Access

Moody’s: Quality Reserve Base Earns Range Rating Upgrade

Citing the quality of Range Resources Corp.’s reserve base, Moody’s Investors Service on Thursday upgraded the Houston-based company’s corporate family rating to “Ba1” from “Ba2” and its senior subordinate rating to “Ba2” from “Ba3.”

Moody’s also assigned Range a speculative grade liquidity rating of “SGL-2,” and said the rating outlook is stable.

“Despite having a scale that is comparable to higher rated E&Ps, historically Range’s significant outspending of internally generated cash flow to develop natural gas assets has been an area of concern,” said Moody’s Vice President Stuart Miller. “However, we have become increasingly satisfied that the quality of Range’s reserve base can support a Ba1 rating as we expect productivity to improve as the company begins to drill longer horizontal laterals with a greater emphasis on pad drilling.”

The upgraded family rating reflects Range’s “investment grade size and scale, as well as the company’s significant organic growth over an extended period of time,” Moody’s said. “As measured by reserves, Range is currently the largest of its Ba1 exploration and production (E&P) peers, while its production is roughly equivalent to the Ba1 average.” In addition to production averaging 150,000 boe/d and proved developed reserves of nearly 600 million boe, Range has a proved developed reserve life of nearly 11 years, according to the ratings service.

“It addition, the company has identified 6,750 potential drilling locations in its core Marcellus acreage, providing substantial growth opportunities beyond its developed reserved base,” Moody’s said. While Range’s concentration in natural gas and natural gas liquids results in weak cash margins of less than $20/boe, the company operates 89% of its total proved reserves, enabling it to scale back if necessary. “Moody’s projects that Range will slowly gravitate to a more balanced approach where cash flow will fund a greater portion of spending, thereby addressing the weak retained cash flow to debt metric,” the ratings agency said.

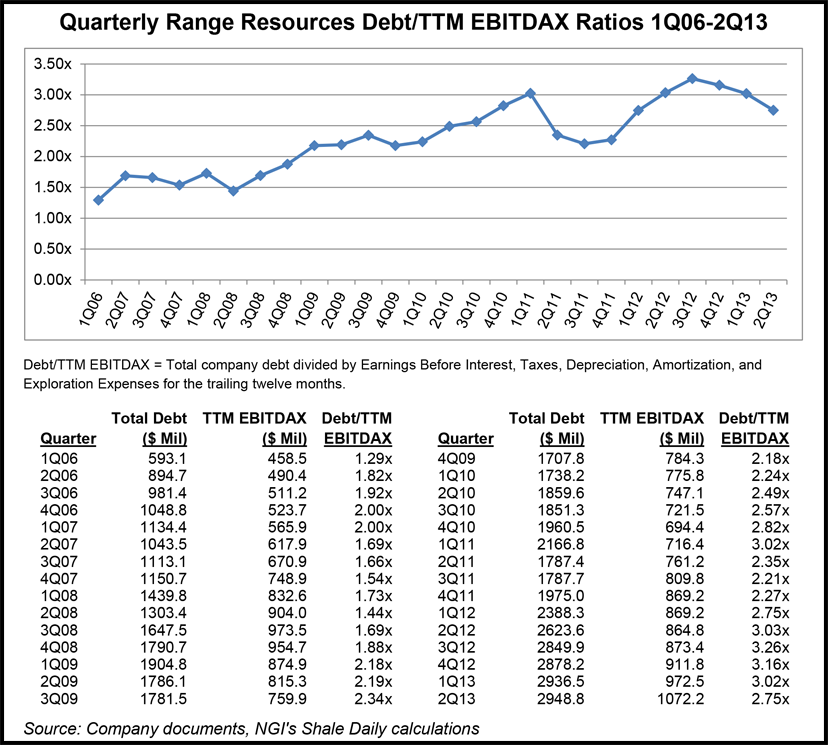

Range’s debt upgrade comes despite the fact that its total debt-to-EBITDAX (earnings before interest, taxes, depreciation, amortization, and exploration expenses, a measure that is a proxy for cash flow) ratio has been trending upward since 2006. However, that ratio has fallen the last three consecutive quarters, moving from 3.26x in the 3Q12 to 2.75x in 2Q13.

Bolstered by record production, especially in the southwest Pennsylvania portion of the Marcellus, and revisions to its estimated ultimate recovery (EUR) curves, Range last month reported net 2Q2013 earnings of nearly $144 million (see Shale Daily, July 26). Range also reported record production of 910 MMcfe/d in 2Q2013, a 27% increase over the 719.3 MMcfe/d it produced in the year-ago quarter. The company said EUR in the super-rich area of the Marcellus, in southwest Pennsylvania, would increase 38% over 2012, to 1.82 million boe (10.9 Bcfe). In the wet and dry gas areas, EURs were increased 41% and 63%, to 12.3 Bcfe and 12.2 Bcf, respectively.

Range holds about 540,000 net acres in southwest Pennsylvania. It classifies 110,000 of those acres as super-rich to the Marcellus, while 220,000 acres are wet and 210,000 are dry gas.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |