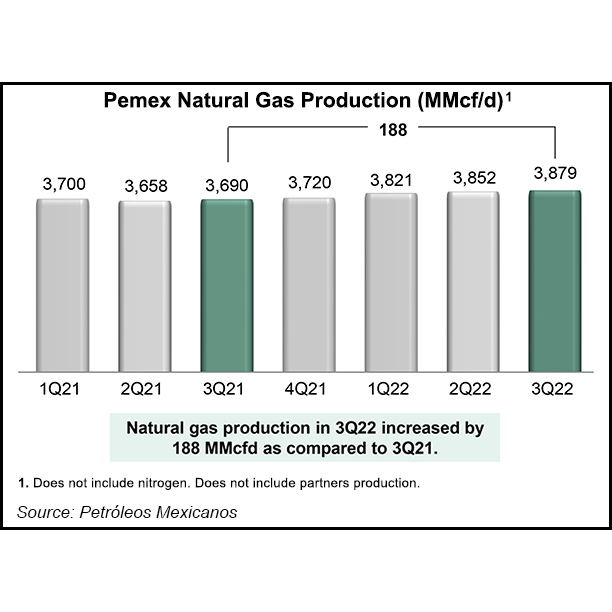

Mexico’s state oil and gas giant Petróleos Mexicanos (Pemex) had a strange third quarter. Amid record commodity prices, the company posted a massive loss. But it also produced more hydrocarbons, in particular natural gas.

In an earnings call last week, executives tried to put a positive spin on the results. They highlighted that Pemex liquids production hit 1.764 million b/d in the quarter, up by 24,000 b/d year/year.

The company’s main source of income, crude exports, “remained stable” in the quarter, acting CFO Carlos Cortez said.

Executives said that their strategy of focusing on new, so-called priority fields in the onshore and shallow water of the nation’s southeast was paying off, with some 74,000 b/d added on the completion of 15 wells in the third quarter....