Management at Mexico’s Petróleos Mexicanos (Pemex) thinks its strategy to focus on 20 new priority fields is starting to pay dividends, with 123,000 b/d of new production added from 15 producing areas by the end of September.

Thirteen wells were drilled at the priority fields during the third quarter, and the company will complete and start production from 27 additional wells in the fourth quarter, executives said Wednesday in an earnings call.

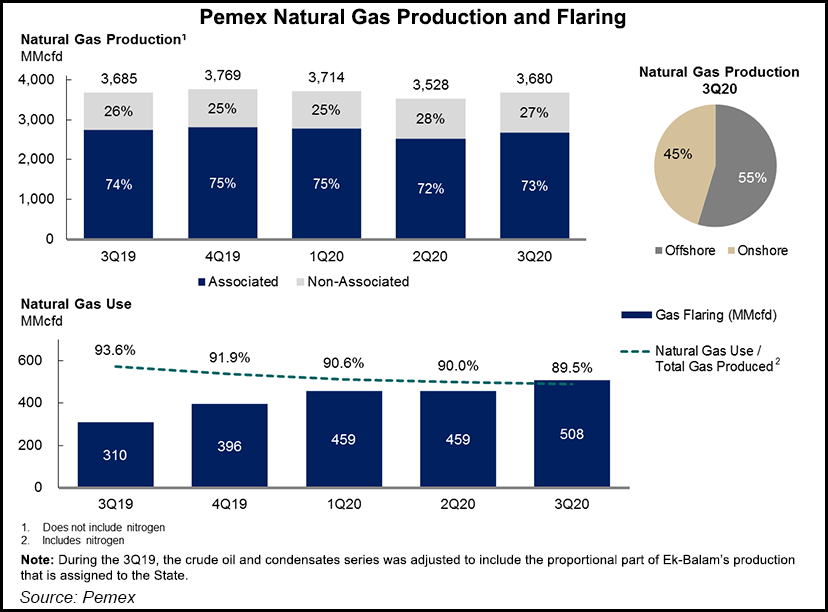

Production was led by the southeastern Mulach, Queschi and Ixachi fields. The latter two are natural gas-rich.

Exploration during the quarter added 600 million barrels of oil equivalent from Quesqui and Ixachi in 3P (proved, probable, possible) reserves.

Pemex CEO Octavio Romero participated in the earnings call for the first...