Regulatory | NGI All News Access

Mexico’s AMLO Downplays Severity of Crude Collapse Despite Pemex Downgrade, Negative Prices

Despite a punishing sequence of events over the last few days for Mexico and state oil company Petróleos Mexicanos (Pemex), President Andrés Manuel López Obrador on Tuesday downplayed the potential impacts of current market turmoil.

In his daily morning press briefing, the president signaled that Pemex may shut-in some production until crude prices recover, despite his government’s refusal earlier this month to accede to a 400,000 b/d supply cut asked of it by the Organization of the Petroleum Exporting Countries.

From his podium at Mexico’s national palace, López Obrador asked, “Why doesn’t the fall in the oil price affect us that much? Because we invested last year in the drilling of wells…now that the oil doesn’t have value, we can close the valves, [and] they don’t lose pressure.”

He added, “If we hadn’t drilled new wells we would be producing less, and what’s more, producing in mature fields” where shutting and reactivating wells takes longer due to the lack of pressure.

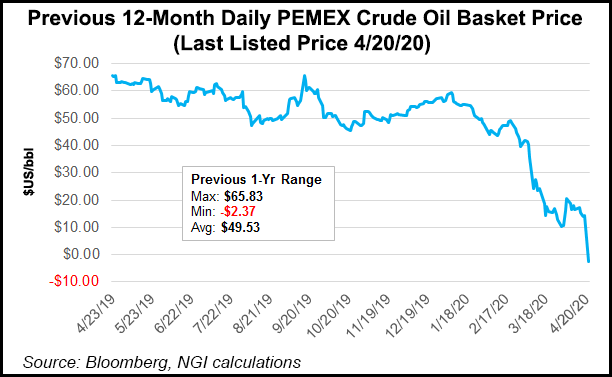

The comments come one day after Mexico’s crude oil basket price, which is linked to the West Texas Intermediate (WTI) benchmark, closed in negative territory for the first time ever, at minus $2.37/bbl, down from a previous close of $14.35 on Friday.

The negative milestone resulted from the May WTI contract settling at an unheard of minus $37.63 as traders sought desperately to offload the contract one day ahead of its expiration amid filling storage tanks and lack of demand because of the Covid-19 pandemic.

The unprecedented negative prices followed a downgrade last Friday by Moody’s Investors Service of Pemex bonds to junk status, a move long predicted by analysts that is sure to further restrict heavily indebted Pemex’s access to capital.

López Obrador said Finance Minister Arturo Herrera, Energy Minister Rocío Nahle and Pemex CEO Octavio Romero Oropeza plan to offer a more detailed plan on Thursday (April 23) of the government’s plans to manage Pemex in the wake of the pandemic and oil price collapse.

Mexico’s central bank Banxico offered a more sober outlook on Tuesday, announcing a key rate reduction of 50 basis points to 6% in an effort “to strengthen channels of…credit and provide liquidity for the healthy development of the financial system.”

Among the major risks facing Mexico’s economy, Banxico board members cited low oil prices and the fact that two credit rating agencies have now lowered their ratings for Pemex debt to below junk status.

Also on Tuesday, the executive branch published a decree in the official gazette authorizing fiscal stimulus of up to 65 billion pesos, or about $2.66 billion, in 2020 for oil and gas companies, including Pemex, that hold production-sharing exploration and production (E&P) contracts.

Of the 112 E&P contracts signed under Mexico’s 2013-2014 energy reform, 35 were awarded under the production-sharing model, while the other 77 pertained to the license model.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |