NGI Mexico GPI | Coronavirus | E&P | NGI All News Access

Mexico Pursues Winning Strategy at OPEC Negotiating Table

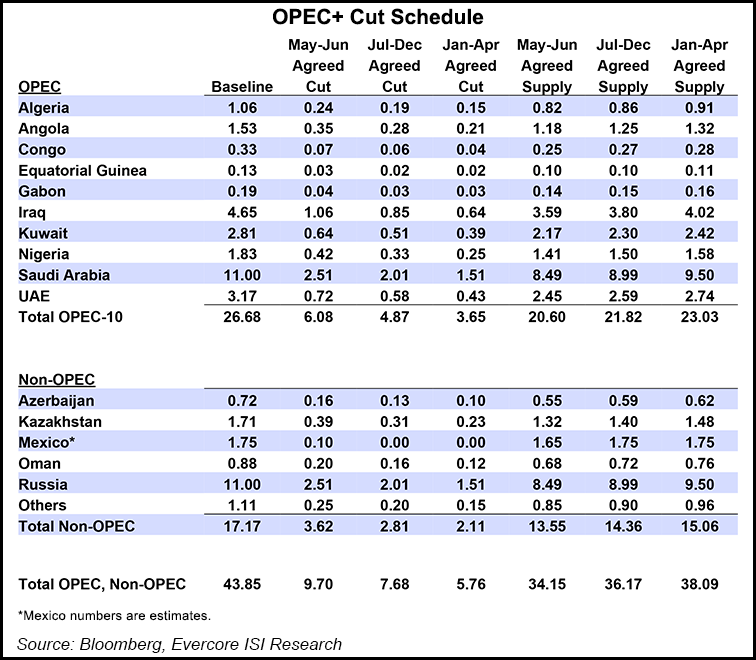

Mexico negotiated down its production cut to only 100,000 b/d in the final agreement hammered out on Sunday between the Organization of the Petroleum Exporting Countries (OPEC) and its allies in their attempt to put a floor on plummeting oil prices.

The country had been asked to cut 400,000 b/d, but Energy Minister Rocio Nahle stood her ground for three days, managing in the end to commit to only 25% of that figure.

Prices barely budged Monday in the wake of the deal. The May West Texas Intermediate (WTI) futures contract lost 35 cents to settle at $22.41/bbl, despite the historic agreement and a Monday morning tweet from President Trump suggesting that the so-called OPEC-plus alliance was actually considering a 20 million b/d curtailment.

“After a four-day marathon of global meetings and arduous and sometimes frustrating negotiations involving the U.S., Mexican, and Russian presidents as well as the Crown Prince of Saudi Arabia, the OPEC-plus group agreed to collectively cut production in May and June by 9.7 million b/d, and to return to market management by committing to a series of cuts through April 2022 to manage the post Covid-19 cycle and the inventory overhang in the next two years,” said IHS Markit’s Roger Diwan, vice president of financial services, in a Monday note.

“I think the Mexico government may have negotiated smartly by recognizing that there was a small percentage of overall cuts that was being asked of them, yet their role was critical because OPEC-plus wanted consensus,” the Woodrow Wilson Center’s Duncan Wood told NGI’s Mexico GPI. “So Mexico was able to say, you desperately need us to get a deal. And then Trump coming out and saying we will help you, that looks like success.”

The United States saying it would reduce output a further 250,000 b/d to help Mexico advance the talks was “probably a payback for things Mexico is doing in stopping the flow of migrants, with the expectation that they continue to do this into the future,” Wood said.

It remains unclear how the United States will follow through on a production cut, however, given that the private sector supplies 100% of U.S oil and gas output.

President Andrés Manuel López Obrador hails from the oil state of Tabasco and claims Lázaro Cardenas, who nationalized Mexican oil and created state oil company Petróleos Mexicanos (Pemex) in 1938, as his role model. Part of his political platform is the promise of a massive oil refinery for his home state, and to reverse more than a decade of production declines.

“It’s an honor to inform you that for the first time in 14 years, we stopped the progressive drop in oil production,” Lopez Obrador told thousands of supporters in Zocalo Square after one year in office last December, when statistics were finally in his favor to be able to claim this win.

Crude oil production in Mexico kept increasing, rising for a fourth straight month in February, to average 1.72 million b/d, compared with 1.7 million b/d in February 2019. Natural gas production averaged 3.9 Bcf/d in February, up from 3.73 Bcf/d.

The president has promised to hit 2.7 million b/d by the end of his term in 2024.

However, many analysts from within Mexico have argued that the cuts were a perfect opportunity for the country to save money in a sinking economy that is beginning to feel the effects of the coronavirus.

Analysis by Welligence Energy Analytics showed that 80% of Pemex’s producing fields are cash flow negative, including taxes, at a $35/bbl Brent oil price. Excluding taxes, 200,000 b/d are uneconomic.

“Mexico lost an opportunity to cut uneconomic oil production by rejecting the OPEC-plus original deal,” Welligence analysts said. “It offered López Obrador a way out of his overly optimistic production promises without losing face.”

The new deal, they said, was a sign of politics winning over pragmatism, even given the fact that Mexico hedges its oil each year as protection against price swings. “Contrary to popular belief, Mexico only hedges 25% of its production, so this wasn’t a catch-all safety net,” Welligence analysts said.

The muted response of oil prices in Monday trading reflected pre-meeting enthusiasm that was “not justified by fundamentals, as the supply-demand imbalance was so large, that normally prices should have been much lower,” said the Rystad Energy oil markets team. The 9.7 million b/d amount is “not enough to bring back healthier price levels and…only sufficient to maintain prices largely unchanged.”

On the other hand, if the Group of 20 (G-20) countries can supply additional cuts of up to 10 million b/d, “then we can expect a relative price recovery,” Rystad analysts said.

The agreement “is a critically needed relief in the face of declines in crude demand estimated at around 20 million b/d,” said Diwan. “Stepping away from a destructive price war, the return to market management by Saudi Arabia and Russia and backed by the United States and a very involved President Trump, marks a physical and psychological inflection point for the oil market.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |