European Union (EU) natural gas storage inventories are trending below the 5-year average, setting the stage for a potential boost for U.S. exporters in the coming weeks and months.

“Low EU gas stocks are good news for U.S. LNG exporters, notably as U.S. LNG netbacks are relatively high for both Asia and Europe, which should support a high level of U.S. LNG exports this summer,” said Julien Hoarau, head of Engie EnergyScan.

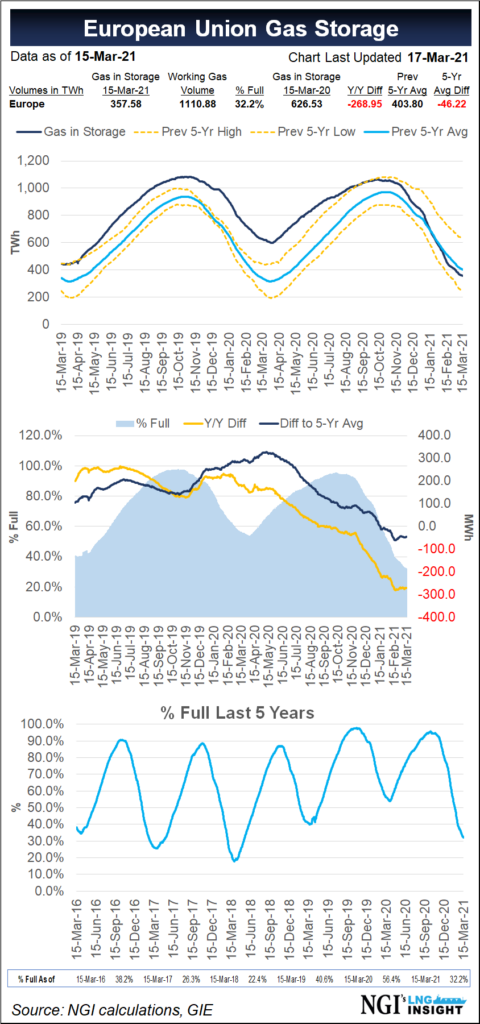

As of Monday, there were 361 TWh of natural gas in storage in the EU, equivalent to 32.5% of the region’s capacity, according to NGI data. That is almost 270 TWh below year-ago levels, and 47.3 TWh below the 5-year average.

The low amount of gas in storage is largely due to LNG exports being diverted away from Europe to Asia as the Japan Korea Marker...